First things first: how much do I need?

First things first: how much do I need?

To download this report as a printable PDF version, click here.

“Will I have enough?”

This is one of the most common concerns our clients discuss with us. And so, if you’re like most people, you’ve likely asked yourself that question, too. And, by way of an answer, you’ve probably taken stock of the value of your investment and banking accounts.

That makes sense, because how much you save and how you invest that savings not only play significant roles in financial security, they also seem to be among the few things you can control. Many other variables—such as Social Security, interest rates, and inflation—are determined by forces beyond your control.

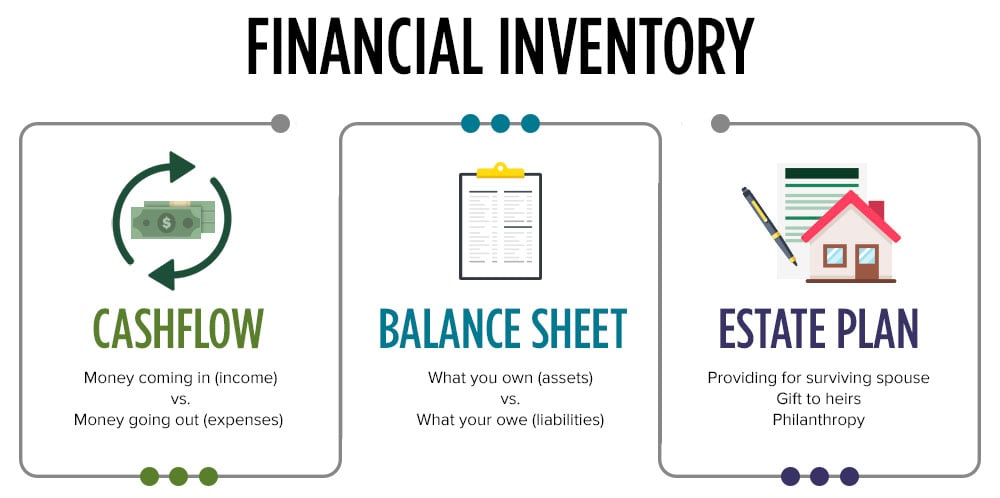

With a bit of planning (and help from our team of Fool Wealth planners), you can marshal all your resources and hopefully improve your chances of living the retirement you want. Start with a financial inventory to know where you stand.

Then think about where you’d like to be—your dream retirement.

What does a fulfilling retirement look like to you?

It may sound surprising as the first question. Many individuals tackle dollars and cents of retirement head-on but forget to define their ideal retirement.

It shouldn't be expressed in terms of a specific dollar amount in the bank or a targeted rate of return on your portfolio.

Instead, your ideal retirement should be characterized by your goals and how your wealth can help you achieve them.

So, before we jump into things like the “4% withdrawal” rule-of-thumb or a potential shift to a more conservative asset allocation that you’ve likely read about, you must first determine what you’re going to spend money on in retirement.

What’s your playbook for the later stages of your life?

As you wound down your working life, you may have been daydreaming about your retirement days.

Did you picture yourself traveling the world or creating an award-winning flower garden?

Were you setting sail on the boat you’ve dreamed about or packing a lunch to take to the beach with your grandkids?

And now that you’re in retirement, has your vision of the decades to come changed?

Our report, “Winning in Retirement,” discusses something we call the “Prosperity Trifecta”—the confluence of essential relationships, core pursuits, and health—that should drive how you live your retirement and how much money you need.

Knitting these elements together will design your investment strategy for the short and long term and inform which sources of income you should access and when.

Living your life

Before we talk about your paycheck in retirement, it’s important to know where your money goes. Each individual spends money differently; it depends on what’s personally meaningful. Despite small proclivities, housing, transportation, and healthcare make up the majority—nearly 58%—of annual spending.

In retirement, you may notice that how much you spend on specific categories has changed. Understanding what you spend and how you expect that to change throughout your retirement will go a long way toward deciding which sources of income you should access and when.

Source: Bureau of Labor Statistics, 2023 Survey

How will spending change through retirement?

Most individuals spend less as they progress through retirement. Data show that of the total U.S. expenditures, Americans aged 45–54 spend the most.

As they reach age 55, expenses decline slightly, but by 75 years old, spending is down over 40%. Even as overall costs fall, spending on certain categories shifts with age.

At ages 55–64, Americans spend roughly 39% more than those over the age of 65. Housing is the largest expense while health care is just 28% of housing costs. But as individuals age, health care grows to 40% of housing costs.

Source: Bureau of Labor Statistics, 2023 Survey.

Your Retirement Paycheck

Talk to any given circle of retirees, and you’ll find that their retirement plans and activities are as varied as they are.

You may retire at an older or younger age than your friends. Your sister may leave her corporate job and decide to work part-time at a dance studio to stay busy and satiate her love of dance. Your brother may call it quits and hit the links every day. And you may take art classes to fulfill your life-long desire to learn how to paint watercolors.

Whatever your retirement looks like, you’ll need income to satisfy your core living expenses and fuel your desired experiences.

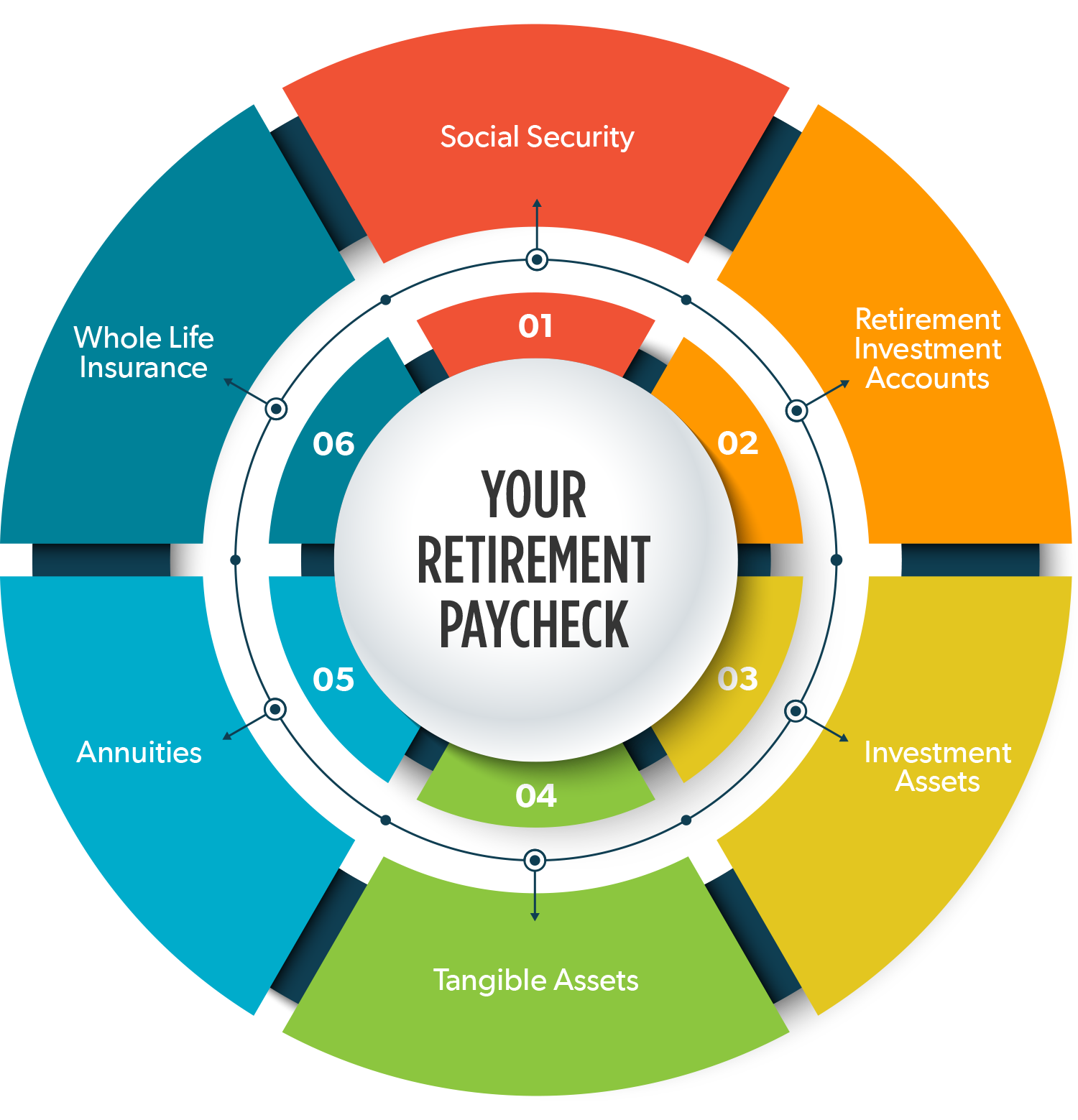

We are going to review six common sources of income available to many retirees. How they knit together to form a paycheck depends on each individual circumstance.

We’ll also share answers to common questions about how and when to access them and whether a surviving spouse or heir may be entitled to them as well.

Social Security

Social Security

At the core of most retirees’ cash flow, the average individual receives 39% of their pre-tax income from Social Security benefits.1 As it’s a significant portion of retirement income, strategies to maximize this benefit should be the top priority for retirees.

Individuals are eligible to receive Social Security benefits at age 62. But that doesn’t mean they should take them right away—they can wait until age 70. It’s an important decision.

Here’s why: Taking benefits before the full retirement age (FRA) reduces overall payouts. The decrease depends on the individual’s year of birth and the age at which distributions start.

| Year of Birth | Full Retirement Age | Total Percentage Decrease from FRA to 62 | New Payment if Claim at 62 |

|---|---|---|---|

| 1956 | 66 and 4 months | 26.7 | $1,466 |

| 1957 | 66 and 4 months | 27.5 | $1,450 |

| 1958 | 66 and 8 months | 28.3 | $1,434 |

| 1959 | 66 and 10 months | 29.2 | $1,416 |

| 1960 or later | 67 | 30.0 | $1,400 |

Source: Social Security Administration. Office of the Chief Actuary, Benefit Reduction for Early Retirement (SSA 2008). Notes: Starting from a $2,000 monthly payment. The percentages are based on calculating the reductions to the full monthly benefit amount at the FRA and expressing those amounts based on claiming age. All percentages are rounded.

Many retirees want to maximize every dollar available. Not a bad strategy! But often, maximizing the benefit means waiting to claim it (or knowing the exact date of your death with precision!).

For Social Security payments that start after reaching the FRA, the monthly disbursement increases. Individuals can earn these delayed retirement credits each month up to age 70. Like the decrease, the amount of credits depends on the year of birth and the age benefits start.

| Year of Birth | Full Retirement Age | Total Percentage Increase from FRA to 70 | New Payment if Claim at 70 |

|---|---|---|---|

| 1956 | 66 and 4 months | 29.3 | $2,586 |

| 1957 | 66 and 4 months | 28.0 | $2,560 |

| 1958 | 66 and 8 months | 26.7 | $2,534 |

| 1959 | 66 and 10 months | 25.3 | $2,506 |

| 1960 or later | 67 | 24.0 | $2,480 |

Source: Social Security Administration. Office of the Chief Actuary, Effect of Early of Delayed Retirement on Retirement Benefits (SSA 2010). Notes: Starting from a $2,000 monthly payment. The percentages are based on calculating the increases to the full monthly benefit amount at the FRA and expressing those amounts based on claiming age. All percentages are rounded.

So why do roughly one-third of people start claiming at age 62? Did they miss the memo about the “raise” you get for waiting longer?

Social Security is both an income stream and a risk mitigation tool. A lot can happen in the eight years between age 62 and age 70, and if you receive a payment every month, it means there’s less stress on your portfolio. This is essential in the early retirement years when the stock market’s returns can make or break a retirement withdrawal strategy.

So, if the tradeoff of waiting is overstressing other assets or income streams, those extra dollars in the future might not be worth it. That’s why we believe it’s more important to optimize Social Security for your situation rather than reaching for a maximized benefit at any cost.

The timing of when to collect Social Security is a critical decision for individuals who:

- Currently or have been married, particularly if the spouse:

- has a significant age difference—of at least three years—or

- there’s a substantial difference in earnings history

- Have minor children when they are eligible to claim

- Have a family history or actual health factors that may suggest a shorter or longer than average life expectancy

An important fact to know is that your surviving spouse and heirs are eligible to receive your Social Security benefits after you pass away. And again, there are a handful of calculations that factor into how it works:

Spouses can claim benefits at age 62 but receive only about three-quarters. The amount depends on when they're collected. Unfortunately, spouses don't get credits if they wait until age 70.

Surviving heirs can claim benefits slightly earlier, at age 60; those payouts are also reduced by at least 28.5%.2 They, however, are entitled to credits.

Tax implications of collecting Social Security depend on your overall income. Most recipients will have 85% of their benefit included in taxable earnings at the Federal level. Each state also decides how it will tax Social Security, with 42 states not taxing any benefits.

Action Steps

Don’t wait for the annual Social Security letter to see your estimated cash flow. Establish a “My Social Security” account at ssa.gov to understand and keep up-to-date with your retirement benefits.

A Hypothetical Case Study:

How Much You Receive Depends Partly on What Age You Take Benefits

Monica was born in 1961 and just turned 62. She is trying to determine the change in her Social Security benefits if she starts them today.

According to the Social Security Administration, Monica is at her full retirement age when she turns 67. At her FRA, she could expect to receive $2,000 each month.

If Monica chooses to take her benefits at age 62, they will be reduced for each year before her FRA of 67, declining 30% in total (Table 1 in the previous section). So instead of receiving $2,000, she would receive $1,400 at her full retirement age.

However, if Monica waits until age 70, she would receive delayed retirement credits starting at her full retirement age of 67. Those credits would increase her benefits by a total of 24%, giving her $2,480 each month (Table 2 in the previous section).

This hypothetical case study does not represent any specific client’s experience with services provided by Motley Fool Wealth Mangement. This example is provided solely for illustrative purposes.

When Should You Apply for Social Security?

Is claiming benefits at age 62 a mistake? Not always. Here are some factors to consider as you ponder what’s right for you.

Will you live longer than average?

About one of every four people age 65 will live past age 90. One in 10 will live past age 95. When delaying benefits, the breakeven point (the point when you receive more from Social Security than if you had taken it earlier) usually ranges from age 78 to 82. But if your relatives tend to live longer-than-average lives, you may want to delay benefits.

Do you need the money?

If you’re ill, have a shortened life expectancy, or face limited resources, it may be necessary to take Social Security early. Here’s one quick rule of thumb: If you expect to live to at least 80 and can use other resources until age 70, delaying could be best for you. If one or both of these circumstances are not the case for you, it might make more sense to take your benefits earlier.

Do you have a spouse or dependents?

The age at which you apply for benefits locks you into a benefit base for the rest of your life. Your benefit base might affect your spouse’s benefit, both when you’re alive and if you die first. So if you take your benefits before your FRA, then the benefits your spouse could potentially receive would be reduced.

But your spouse will always receive the highest payment—whether it is the reduced amount from you or your spouse’s own Social Security. The benefit base can also determine disbursements to other family members. Thus, it is crucial to coordinate benefits with a spouse when deciding to apply for Social Security.

Want to reduce stress on your portfolio?

Instead of maximizing your benefit, you may enjoy peace of mind knowing that you have a steady cash flow. Or you may want to let your portfolio compound by not withdrawing funds just yet. The earlier you claim your benefit, the sooner you’ll receive those reliable payments, and your investment portfolio won’t have to do as much heavy lifting.

Retirement Investment Accounts

Retirement Investment Accounts

There are about as many types of retirement accounts as ice cream flavors (or at least it can feel that way!). The two most common categories are defined benefit and defined contribution plans.

Defined benefit plans are typically known as pension plans. These are offered through an employer. But they are phasing out as only 15% of workers in the private sector have a defined benefit plan, which is down from 60% in the early 1980s.3

How much is your pension worth?

If you expect to receive a pension from your current or past employer, contact the company’s human resources department or plan administrator offering the plan to get an estimate of your benefit. They should provide a “Summary Plan Description” to detail how much your pension is worth and explain the plan’s claim procedures. And to see your specific benefit, request a benefit statement from the plan provider.

Even though your benefit doesn’t change over time, the success of the pension plan is still dependent on the plan’s funding levels and how it achieves the investment growth required to pay your benefit. If you work for a public company, you can check to see how healthy your pension fund is by reviewing the company’s publicly available annual report. According to a study conducted by the consulting and actuarial firm Milliman, the average corporate pension funding ratio was 106.2% in 2025, up from 96.3% in 2021.* If you have a pension through a state or local government, its funding status is also publicly available.

*Pension Funding Index September 2025, Milliman, accessed September 25, 2025.

Benefits typically start at age 65, although some plans allow for early distributions beginning at age 55. Like Social Security, if payments commence before the full retirement age, the monthly payout is likely decreased.

Retirees receive a fixed amount—an annuity—for the rest of their lives, and that amount is unaffected by the ups and downs of the stock and bond markets. Some plans allow participants to take a lump sum distribution instead. Individuals can roll a lump sum payment into an IRA and invest more strategically for their risk tolerances and wealth goals. Sometimes participants can borrow from their pension, offering a source of income in a time of need.

A surviving spouse or dependent child may be eligible to receive a deceased person’s pension. The Employee Retirement Income Security Act of 1974 (ERISA) provides a survivor benefit—called a qualified joint and survivor annuity (QJSA).4 Over the surviving spouse’s lifetime, they will receive payments that are at least half of what the participant received during their joint lives.

Pensions’ tax rates are equal to ordinary income rates, but there may be exceptions, particularly at the state level. Many states do not tax pensions paid by the state—such as those given to teachers or government workers—and several don’t tax pension income at all.

Action Steps:

Request a benefit statement from your human resources department or plan administrator that shows an estimate of your benefits and your current payout elections. Plans often allow participants to take a lump sum distribution, providing better long-term appreciation potential than what the pension plan offers.

Defined Contribution Plans

Defined contribution plans include 401(k)s, Thrift Savings Plans (TSP), and 403(b)s. These plans do not offer a specific benefit amount—it depends on how much the participant (that’s you) contributed and how the money was invested and grew over time. An investment statement can clarify contributions and the balance of the account.

Participants can begin taking distributions at age 59½ but are generally required to start taking distributions by age 73—known as the required minimum distribution.

But taking money from your retirement accounts requires some mental reprogramming on the tax front. You’ve been trained to avoid taxes. But in retirement, you have to switch gears to managing taxes. Rather than mitigating taxes at the top marginal rates as you did while working, you're building your tax situation from the ground up in retirement, starting at a 0% bracket and working up the ladder. The flexibility you have is a function of the amount of money you need to maintain your lifestyle and where it falls within the tax bracket thresholds. The lower your income needs, the more flexibility you have.

Defined contribution plans are assets owned and controlled by you. Any assets remaining at your death will pass to the beneficiaries you name on the account. In many cases, people name their spouse as the beneficiary, and the surviving spouse has the most flexibility in distribution options upon inheritance.

Traditional IRAs and Roth IRAs are other types of retirement accounts. There are differences between the two types that could make one more desirable for individual circumstances.

| Traditional IRA | Roth IRA | |

|---|---|---|

| Mandatory Withdrawals | By April of the year after reaching age 73 | None |

| Taxes on Withdrawn Funds | Individuals may incur a tax and penalty by withdrawing money before age 59½ | Contributions (not the growth) can be withdrawn tax- and penalty-free |

| Estate Planning | Similar rules apply to heirs that applied to original owner* | Provides tax-efficient inheritance* |

| Distribution Period | Spouse**: Can stretch over lifetime Non-spouse: Most are required to take all distributions within 10 years of original owner’s death |

None |

| Taxes on Inherited Assets | Taxed at beneficiary’s tax rate | Not taxed |

*For specific rules on inherited traditional and Roth IRAs, see https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary. **In addition to spouses, minor children, beneficiaries less than 10 years younger than original owner, and disabled beneficiaries can also stretch distributions over their lifetime. Source: IRS

Investment Assets

Investment Assets

Investments beyond what’s in retirement accounts—especially stocks—are another vital source of income for retirees. That may be surprising for many individuals. Conventional wisdom has labeled stock investing too risky in retirement, pushing individuals toward fixed-income assets such as bonds.

For years, the rule of thumb had been to go with a 60/40 split of stocks to bonds by age 65. But, depending on the individual’s circumstances, a portfolio that skews too heavily toward cash and bonds might leave money on the table over the long term.

To get started, individuals first need to determine the proper asset allocation of stocks or bonds for their circumstances, goals, time horizon, and comfort level with risk and volatility.

If you are more risk-averse and seek a bigger cash cushion, you can consider a “cash carve-out strategy.”

You set aside the capital you need for daily living costs for the next three to five years. The goal is to have enough money to ride out market downswings without being forced to liquidate at inopportune times.

If you decide to follow the cash carve-out strategy, the remaining funds in your investment account(s) should have one goal: growth.

Stocks are better than bonds at outpacing inflation and delivering superior returns over the long term. The historical average annual inflation rate is 3.8%—which means prices double about every 20 years.5 It’s vital that your money stays ahead of inflation. Why? Because many individuals’ retirements span two, three, or even more decades.

Want to live off the income produced by your stock portfolio?

The generally accepted rule of thumb to successfully fund a 30-year retirement is to spend 4% to 5% of total savings each year. Yet, some retirees expect to “live off the income” by only spending the income produced from their portfolio. Here’s why that may not make sense.

Stock investors get paid in two ways—when they sell a stock for more than they paid (appreciation) and when they receive dividends.

The average annual dividend for the S&P 500 in the 1970s and 1980s was over 4%, which allowed retirees to leave principal intact while they lived off the income stream from their investments.

But since 1990, the average annual dividend yield has been 2%.* That low level makes it incredibly challenging to live off income alone.

At Fool Wealth, we believe that a 4% to 5% spending rate is still sustainable, but it does require dipping into a portfolio’s appreciation to supplement dividends.

Tangible Assets

Tangible Assets

Most individuals own appreciating assets that can provide income in retirement. A house is a typical example. Retirees often downsize once their children have left the nest or move to warmer-weather states that have advantages of cheaper housing and lower taxes. Other examples include collectibles, such as baseball cards or art. Although not widely held, and the market for them may be small, some may provide a hefty payday!

And then there’s rental property. Approximately 7% of retirees turn to rental property as an enticing stream of monthly income.6

Owning an investment property can prove lucrative and make sense in certain circumstances. But it requires a great deal of thought and planning to determine if it’s the right decision for you—because you don’t want a potential source of income in retirement to shift to an unprofitable source of more expenses.

Another way to get exposure to the real estate market without the hassle and potential risk of outright owning real estate is to invest in a real estate investment trust (REIT) that trades on the major stock exchanges.

Top 10 Places to Retire

Wondering about the best places to retire in U.S.? The top 10 rank well on a combination of factors, such as housing affordability, happiness, desirability, retiree taxes (including if Social Security is taxed at the state level), and health care quality.

Source: U.S. News & World Report, September 25, 2025.

Is a real estate investment property right for you?

Thinking of becoming a landlord to generate income in retirement? Here are some key aspects to keep in mind:

Initial purchase

The key is to purchase the right property at the best price with optimal terms. What’s the best price and terms? It’s the point at which the property is cash flow positive. In other words, will the forecasted monthly revenue (rental income) exceed the monthly costs of operating the dwelling (including mortgage, insurance, property taxes, maintenance, and utilities) plus the profit (income) required?

Ongoing maintenance

Consider these questions:

- Are you willing and able to respond to emergency—and non-emergency—calls from your tenants? If you expect to travel often or spend part of the year as a snowbird, this may be exceedingly difficult. You can hire a property manager to tend to these details, but typical costs are about 10% of monthly rental income, making it more difficult to turn a profit.

- Will you need to hire laborers to fix issues, or can you do it yourself?

- Do you understand the legal and financial risks of potentially being sued?

- How will you find good tenants?

- How could a loss of rent via vacancies, tenants not paying (squatters), and damage above a security deposit affect your break-even point?

Other costs

Maintenance expenses are only part of the costs associated with rental property ownership. You also need to factor property taxes into your break-even analysis. Insurance is another mandatory cost. You may also consider getting an umbrella policy to further insure against a lawsuit.

Liquidity

Selling a property is more complex than selling a stock, for example. You may not be able to sell the property promptly or for the price you expect. It can also be costly—property sales can incur costs of 6% or more of the price. If you need money immediately, this asset may not offer you that flexibility, forcing you to access cash from other sources.

Opportunity Costs

Another common mistake is looking at what income “should” be without modeling the reality of capital improvement, maintenance, and other homeownership expenses. Landlords often view their cash flow through rose-colored glasses without analyzing potential income from an equivalent investment in the stock market. Suppose you divide your annual income by the equity in the property and have less than a rate of 4%. In that case, it may be prudent to consider traditional investing rather than income-producing real estate.

Annuities

Annuities

Before we dig into annuities as an income stream, we should note that the decision to buy an annuity is very different than the decision to keep an existing one. Individuals would need compelling reasons to terminate a contract of a purchased annuity.

Many people consider an annuity to be an investment, but the structure of an annuity is an insurance policy. It is essentially longevity insurance—where you’re exchanging risks and volatility associated with investing for the security of a likely stable income stream.

When a client comes to us with an existing annuity, we look at the contract to understand the payout options and the various benefit riders that may be in effect.

We also look at the client’s particular situation, because annuities are typically best utilized for clients who cannot stomach stock market volatility or simply want a regular income stream without worrying about what to sell in their portfolio.

For clients prioritizing legacy goals (leaving money to heirs or charity) or who want to maximize their wealth growth during their lives, annuities are, in our opinion, rarely a good solution.

Should you get an annuity if you don’t already have one?

Are you considering buying an annuity in retirement?

Recall that annuities are contracts based upon some sort of insurance. For individuals who are not able to stick to their wealth plan in the event of a market downturn—whether they cannot stomach losses or don’t have the capacity to lose capital—then an annuity may be a good choice.

But others who can stick to their plan will likely generate a higher return with their investments outside an annuity. That’s because annuities charge fees of several percent a year and strive to capture the market average, which means the after-fee performance typically falls below the average.

If you are still considering buying an annuity in retirement, you likely won’t have a lengthy period to contribute. So some retirees consider an immediate annuity, which provides income almost immediately after making a lump-sum investment. The amount of income differs depending on several factors, such as age, gender, and the current interest rate: typically, the higher the interest rate and the older the individual is, the bigger the payment. But over the last 10 years, interest rates have averaged just 1.0%.

There are some benefits to annuities, such as receiving regular income streams, growing contributions tax-deferred, and the availability of death benefits.

But there are also downsides. First, fees can be high, especially if additional benefits, like a death rider, are added. Second, annuity returns tend to be lower than investing directly in the market. That’s due to the annuity fees and the overall mandate of targeting average market returns.

Taxes may also be higher with annuities. While contributions are tax-deferred, withdrawals are taxed at ordinary income rates.

Conversely, stocks are taxed at capital gains rates, which tend to be lower, especially for long-term gains.

Finally, getting out of an immediate annuity is difficult, if not impossible. And the remaining income generally does not pass to beneficiaries.

Whole Life Insurance

Whole Life Insurance

Do you own a life insurance policy without a fixed term of coverage?

If so, it’s probably a whole life policy with a pre-determined death benefit and a cash value—which may be earning tax-deferred interest and dividends.

The cash value is accessible during retirement in two ways, but because of nuances, we believe it’s the income source of last resort:

Borrow or withdraw a lump sum

Generally, holders can borrow against the policy up to the amount of cash value without owing tax. Additionally, if dividends are received, taxes are not due until they exceed the total amount of premiums paid.

Borrowers don’t have to repay the loan. But unpaid loans reduce death benefits and could impact ongoing coverage.

Convert to an annuity

Receive a fixed amount for the remainder of life. Upon death, some may even continue providing benefits to a surviving spouse or heirs.

Converting to an annuity is not simple; it may affect death benefits and trigger a tax bill, so consult with an insurance broker or tax advisor to understand the full ramifications.

How they stack up

How they stack up

Most individuals have access to several of the sources highlighted in this report, and maybe some others not discussed. But not all income streams are equal, so it’s essential to consider which you should access and when. Some of the factors that influence that decision include:

Age at retirement

Did you end your career in your late 50s or early 60s? If so, there's a gap between when some of the sources kick in and your last paycheck. That lull in income may necessitate pulling more assets from flexible sources or looking at Roth conversions as a potential longer-term planning strategy beyond just paying today’s bills.

What are RMDs?

Pension, 401(k), and traditional IRA participants must take required minimum distributions (RMDs) each year*. However, some plans allow participants to defer RMDs if they are still working past the required age.

The amount of RMDs is determined by the account’s prior end-of-year fair market value and the distribution period or life expectancy. Your plan administrator typically calculates RMD amounts. The IRS also provides worksheets to determine your annual distribution.

Distributions are taxed at ordinary income rates. For individuals who do not need the income, a wealth planner can help you strategize on alternative uses—such as making a charitable gift—to reduce the associated tax bill.

Required distributions

Some sources mandate that you take a specific portion by a certain age. Pensions typically start at “retirement age,” often 65, and retirement accounts typically require distributions to start by age 73.

Income needs

How much do you require for your core life needs and surplus expenses? What do you do if your income exceeds your expenses? Generally, the lower your income needs, the more flexibility you have with where you pull from.

Taxes

Are taxes a concern, and do you want to minimize what you may owe? For individuals who don’t need income, they may consider accelerating income into a Roth conversion as a long-term planning strategy or charitable gifting to lower taxes.

Legacy

Do you wish to leave money to heirs or a charitable organization? There are charitable donation options that also generate cash flow for you, so it may be worth considering a donation during your lifetime rather than leaving a gift upon death.

It's OK to spend

One of the most challenging transitions that many investors make is from employment into retirement. We talk about financial independence or retirement being the goal—we look forward to it; we celebrate it—but the reality is that it can be a difficult change.

Often, we’re so conditioned to save for retirement that we forget that it’s ok to spend the money we put away once we’re in it. After all, that was the point of saving!

So, when assessing your retirement paycheck, one of the most important questions you should ask is:

Why do I want to generate income?

You may have a particular reason for not wanting to spend your retirement savings. Maybe you want to leave money to your heirs or support a charitable cause close to your heart. If legacy matters to you, make it part of your budget for your retirement paycheck.

The critical thing to remember is that—unlike when your boss was in control—you are now the supreme ruler over your income sources and how to use them.

In retirement, you're the CEO!

Footnotes and Disclosures

1 Center on Budget and Policy Priorities. Accessed September 25, 2025.

2 Social Security Administration, accessed September 25, 2025. Surviving heirs can receive no more than the retired worker would have received.

3 U.S. Bureau of Labor Statistics. Accessed September 25, 2025.

4 IRS and Department of Labor, accessed September 25, 2025.

5 Worlddata.info. 3.8% through 2024. Investopedia. Accessed September 25, 2025.

6 IRS. Accessed Septemeber 25, 2025.

This Report is provided for informational purposes only, reflects our general views on investing and financial planning, and should not be relied upon as recommendations or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Similarly, while we can counsel on tax efficiency and general tax considerations, Motley Fool Wealth Management (“MFWM” or "Fool Wealth") does not (and is not permitted to) provide tax or legal advice. Clients who need such advice should consult tax and legal professionals. These comments may not be relied upon as personalized financial planning or tax advice.

Unless otherwise indicated, the information contained herein is believed to be accurate as of July 2024. No representation or warranty is made as to its continued accuracy after such date, and MFWM does not undertake any duty to update any of the information presented herein. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. The Report also contains the current opinions of MFWM and such opinions are subject to change without notice, and such changes may be significant. There can be no assurance that such opinions are or will remain accurate, or that other opinions or methodologies would not produce different results.

* We generally focus on direct equity investments. However, we may invest in exchange-traded funds (ETFs) when we believe that it is most efficient and appropriate to obtain exposure to an asset class. When we utilize ETFs, we seek to utilize low-cost ETFs. Certain of our strategies, however, may heavily utilize or invest exclusively in ETFs, such as International and Fixed Income. Depending on the strategy, the underlying ETF fees and expenses may be significant.

** To the extent we invest more heavily in particular sectors or industries of the economy, your performance will be especially sensitive to developments that significantly affect those sectors or industries. While investing in a particular sector is not a principal investment strategy of any Model Portfolio, client portfolios may be significantly invested in a sector or industry, such as the information technology sector, as a result of our portfolio management decisions. Similarly, a Model Portfolio’s investment may become concentrated in a small number of issuers. To the extent that we take large positions in a small number of investments, account returns may fluctuate as a result of changes in the performance of such investments to a greater extent than that of a more diversified account. Returns realized by a client account may be adversely affected if a small number of these investments perform poorly.

Motley Fool Wealth Management is an SEC-registered investment advisor with a fiduciary duty that requires it to act in the best interests of clients and to place the interests of clients before its own. HOWEVER, REGISTRATION AS AN INVESTMENT ADVISOR DOES NOT IMPLY ANY LEVEL OF SKILL OR TRAINING. Access to MFWM is only available to clients pursuant to an Investment Advisory Agreement and acceptance of MFWM’s Client Relationship Summary and Brochure (Form ADV, Parts 2A and 2B). You are encouraged to read these documents carefully. All investments involve risk and may lose money. MFWM does not guarantee the results of any of its advice or account management. Clients should be aware that their individual account results may not exactly match the performance of any of our Model Portfolios. Past performance is no guarantee of future results. Each Personal Portfolio is subject to an account minimum, which varies based on the strategies included in the portfolio. MFWM retains the right to revise or modify portfolios and strategies if it believes such modifications would be in the best interests of its clients.

During discussions with our Wealth Advisors, they may provide advice with respect to 401(k) and IRA rollovers into accounts that are managed by Motley Fool Wealth Management. Such recommendations pose potential conflicts of interest in that rolling retirement savings into a MFWM managed account will generate ongoing asset-based fees for Motley Fool Wealth Management that it would not otherwise receive.

Motley Fool Wealth Management, an affiliate of The Motley Fool, LLC (“TMF”), is a separate legal entity, and all financial planning advice and discretionary asset management services for our clients are made independently by the wealth advisors and asset managers at Motley Fool Wealth Management. No TMF analyst is involved in the investment decision-making or daily operations of MFWM. MFWM does not attempt to track any TMF services.

WM-1009-RP-2025-10