To print this report or save it as a PDF, click here.

The end of the year is fast approaching

... And so is a frenzy of activity. There’s preparing for holidays, attending parties, going through lists,

reliving accomplishments, and setting resolutions. It should also be a time to make sure your finances are in order.

But with so much going on, a financial review often falls through the cracks.

Unfortunately, that can be very costly because many wealth planning opportunities have a Cinderella-like time limit — as the clock strikes midnight on December 31st, they too are lost!

No worries, though! We’re here to lend a helping hand this year, to keep you at the top of your game.

We’ve gathered our in-house team of Wealth Advisors to provide this collection of eight wealth planning strategies you should consider for year-end.

Before we begin, we want to note that while we can offer insights on tax efficiency and discuss tax considerations in a general way, Fool Wealth does not (and is not permitted to) provide tax or legal advice.

Remember, the discussion of tax strategies in this report is intended for educational purposes only, and should not be relied upon as personalized tax or financial planning advice.

If you need such advice, please consult with your own tax and legal professionals before making any big decisions.

We should also note that the examples included in this report are hypothetical, and do not reflect the personal financial situations of actual Fool Wealth clients, or any advice we have provided to a specific client.

With all that said, let’s dig in!

When should you seek planning advice?

Everyone, regardless of age, can benefit from a well-thought-out wealth plan. And because life is not static, that plan should be flexible and revisited at least annually to adjust to shifting life circumstances.

In addition, there are four specific situations that warrant seeking advice from a professional:

- Annual Limits

Maximize the advantages from IRS rules that place annual limits — such as contributions to retirement plans. - Legislative Changes

There are often changes to laws or new bills that may affect your wealth plan. For example, the recent passage of the Inflation Reduction Act may impact your healthcare costs. Or the student debt forgiveness announcement could provide more assets to invest for retirement. - Time-bound Benefits

Avoid the risk of losing out on one-time or soon-to-end benefits — such as investing in Opportunity Zone Funds or tax provisions that are coming to an end, like the backdoor Roth conversion (which has recently been the aim of legislative reform). - Effective Tax Planning

Play the long game on building out tax buckets efficiently or reducing estate taxes upon death.

Where will your income shake out?

Before you execute year-end strategies, you need to know how much money you’ll likely make for the year.

For example, was it a high-income year, or did you experience a pullback in earnings? Be sure to account for “income events” that happened throughout the year, like receiving a bonus, selling a property or business, or exercising stock options.

Accounting for your income is critical for determining which wealth strategies you should implement.

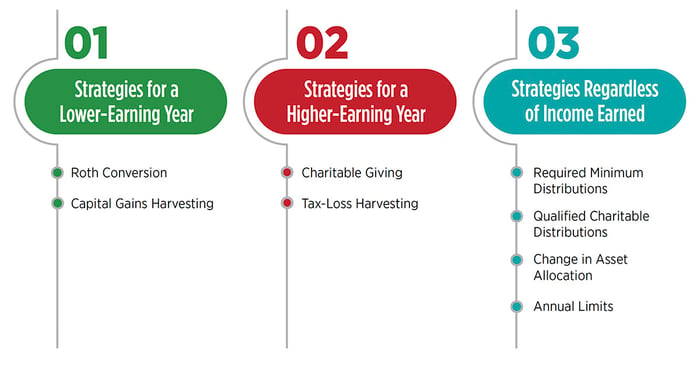

What strategy makes sense for your income?

A comprehensive wealth plan generally has a long-term perspective. But we

believe it should also be flexible to adapt to near-term needs and take advantage of time-bound opportunities. This includes benefits from year-end strategies that could lessen your tax bill. And they should take into account both sides of the tax

minimization equation — income and deductions.

- Getting a tax bargain on income. Recognize income as efficiently as possible at the lowest rate possible.

- Getting a “bang for your buck” through deductions. Recognize deductions at the highest amount possible.

In this report, we’ll share valuable year-end tactics with you that we believe can be applied to your situation. Some tactics can be better suited for a year when wages are exceptionally high. In contrast, others can be beneficial when earnings are on the low end. Lastly, some are favorable all-weather techniques.

Strategies for a Lower-Earning Year

We’ve identified two possible approaches that are advantageous during a year in which you made less money than usual. But because everyone’s circumstances vary, even if these may be favorable when earnings are low, they may not be beneficial or fit with your situation.

Therefore, it’s essential to explore these tactics with a qualified specialist, such as a tax professional or one of our financial advisors. Here are some common reasons you may be experiencing a lower-income year:

- Job loss or furlough

- Parental, sabbatical, or other extended leave without pay

- Pass-through losses from a small business

- Real estate losses from vacancy

1. Roth Conversion

A Roth conversion lets you turn a balance in your traditional IRA or former employer's savings plan, such as a 401(k), into a Roth IRA. This can be a key tactic many individuals may use to reduce taxes in the future and a tax “loophole” that tends to receive a lot of attention.

But before we talk about conversion, let us explain the difference between Roth and traditional IRAs.

| Traditional IRA | Roth IRA | |

|---|---|---|

| Mandatory Withdrawals | Must begin by April of the year after reaching age 73 | None |

| Early Withdrawals | Individuals may incur a tax and penalty by withdrawing money before age 59½ | Contributions can be withdrawn anytime; Earnings may be taxed and penalized if withdrawn before age 59½ or if account is less than five years old |

| Estate Planning | Similar rules apply to heirs that applied to original owner* | Provides tax-efficient inheritance* |

| Provides Tax-Efficient Inheritance* | Spouse**: Can stretch over lifetime Non-spouse: Most are required to take all distributions within 10 years of original owner’s death |

Spouse**: No mandatory withdrawals during surviving spouse's lifetime Non-spouse: Most are required to take all distributions within 10 years of original owner's death |

| Taxes on Inherited Assets | Taxed at beneficiary’s tax rate | Not taxed |

*For specific rules on inherited traditional and Roth IRAs, see https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary. **In addition to spouses, minor children, beneficiaries less than 10 years younger than original owner, and disabled beneficiaries can also stretch distributions over their lifetime. Source: IRS

With a Roth IRA, you contribute after-tax dollars and withdraw earnings tax-free in retirement.1 A key benefit to this type of account is that it can lower your taxes in the future. In other words, once you pay taxes on the money that goes into a Roth IRA, you’re done paying taxes. You also don’t have to take required minimum distributions (RMDs) when you reach age 73, as you do with a traditional IRA. If you don’t need the money, you can keep it invested and pass it to your heirs.

There are two avenues to the Roth IRA — contributing directly or executing a Roth conversion.

To be eligible to contribute directly to a Roth IRA, your income must be below $153,000 for singles or $228,000 for married couples filing jointly. However, there are no income limits on Roth IRA conversions. That’s why a Roth conversion is advantageous for normally high-income earners who have experienced a lower-income year — because the taxes they’ll pay on the conversion will be at a comparably lower rate.

Another good time to convert? When the market is down. Instead of moving cash, convert existing holdings into a Roth. Not only should taxes be cheaper (since holdings will likely have a lower value when the market falls), but when the market recovers, any future appreciation will accrue tax-free.

There’s some math you’ll want to do when considering this move, and a financial advisor can help. You see, even at a depressed rate, the tax bill on the Roth conversion can be substantial.

In the year of the conversion, all transferred monies are subject to ordinary income tax rates. So, for example, if you have $100,000 in a traditional IRA and convert that amount to a Roth IRA, you could owe $27,000 in taxes (assuming you’re in the 27% tax bracket).

And given that the transferred, or converted, money is considered taxable income, if you shift too much, it can push you to a higher tax bracket.

By contrast, although you generally get a tax deduction on your contributions to a traditional IRA — and the money grows tax-deferred — you have to pay taxes on the money as you withdraw in retirement.

Why Would an Individual Want to Take Monies Held in a Traditional IRA and Move Them to a Roth?

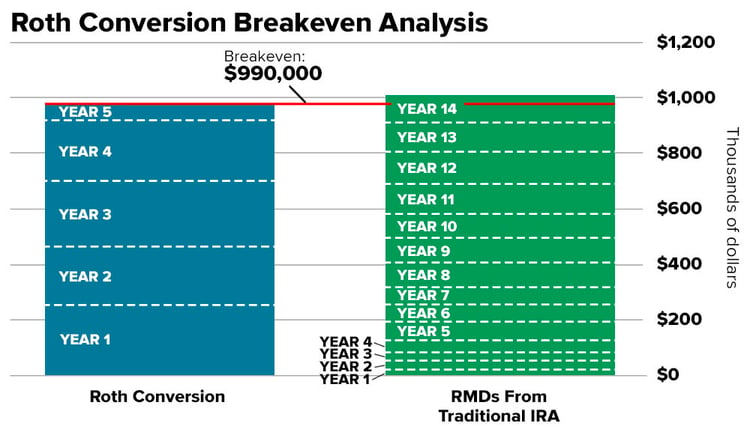

One way to assess whether a Roth or traditional IRA can be well suited for an individual’s situation is to look at a breakeven analysis, which examines the point at which profit and loss are equal. Consider the following hypothetical example:

David and Janice, both in their mid-70s, were contemplating moving their traditional IRA assets into a Roth. The reason was simple: Their RMDs from a traditional IRA exceed their living expenses. In addition, by having a higher income, they may be subjected to increased Medicare premiums or a higher hurdle for deducting medical expenses on their tax returns. But by moving their assets to a Roth IRA, they would not be required to take — or pay taxes — on distributions they did not need.

In this scenario, a Fool Wealth planner can assist with performing a breakeven analysis. Notably, this example assumes that leaving a legacy was not a priority for the clients. The results from this analysis are as follows:

The analysis in this scenario shows that David and Janice’s breakeven for a Roth conversion would be 14 years. Each would be in their 80s before the switch was tax advantageous. In their case, David and Janice along with their Fool Wealth planner, felt it was worth the risk to pay the taxes now because it is likely that one of them will live well into their 80s. Not only is the average life expectancy for men 84.6 years and for women 86.8 years, but both of their parents lived past 90 years old.2

What You Need to Know:

Lock in today’s tax rates and grow tax-free with a Roth IRA

Strategy:

Roth Conversion

What Is It?

Turns a traditional IRA into a Roth IRA, which allows individuals to reduce taxes in the future

Generally Best Suited:

Low-income year

When Should You Do It?

Before December 31. Leave time for assets to transfer during this busy time of year

2. Capital Gains Harvesting

You likely have winners in your stock portfolio, even if the year ends on a down note. If that’s the case, you’re probably conditioned to delay collecting your capital gains for as long as possible. That way, you can defer paying taxes. You therefore might be surprised to discover there are a few smart strategies for how you can use those gains to your advantage now.

Lower Your Tax Bill

If you’ve earned less income this year, and find yourself in the lower tax bracket, it may be an excellent time to harvest some of your gains. That’s because individuals with income of up to $44,625 (single limit + single standard deduction) or $89,250 (joint limit + joint standard deduction) may fall into the 0% long-term capital gains tax bracket in 2023.

If that describes your situation, you could sell just enough of your winners to remain below those taxable income thresholds, and possibly pay 0% capital gains tax on the earnings from your winners.

And unlike capital loss positions, there is no restriction on immediately re-purchasing the same stocks you just sold at a gain. That way you could get a no-tax-cost increase to your stock’s cost basis, representing a permanent tax savings.

Let’s walk through an example:

Joe and Alice, a married couple, project that their combined income will be $60,900 for this year. After they take the standard deduction of $27,700, they could realize up to $56,050 in long-term gains at the 0% rate.

Remember this is only for securities held longer than one year; if held under one year, they would be taxed as ordinary income. Additionally, if Joe and Alice are able to itemize their deductions (due to mortgage interest, taxes, charitable gifting, and medical expenses), then their applicable gross income threshold could potentially be much higher.

Offset Your Losses

In a year where you have enjoyed appreciation on your securities, it can be a popular tax strategy to sell any losers in your portfolio because you are allowed to deduct those losers from your winners and pay a lower tax bill on the net of the two.

So, extending this strategy to a lower-income-earning year, you could sell enough of your winners to offset your losers for a possible net gain of zero and pay zero capital gains taxes on the winners that you sold. It’s a way to sell an appreciated security without paying taxes.

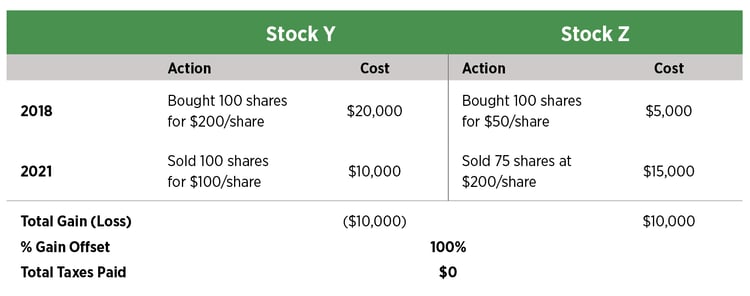

Here’s how it can work. Consider the following hypothetical. Matthew and Kelly want to reduce their exposure to Z company but are worried about the tax consequence of realizing the stock’s appreciation. They recently sold Stock Y for a loss. Their advisor sent them the following analysis to show how they can sell some of their shares in Stock Z and not pay any taxes.

Since the couple recognized a loss of $10,000 when they sold Stock Y, they can sell 75 shares of Stock Z at the market price of $200/share for a gain of $10,000. Because the gain is equal to the realized loss, they should pay zero taxes.

What You Need to Know:

You can take advantage of 0% capital gains rates

Strategy:

Capital Gains Harvesting

What Is It?

Sell appreciated stocks to offset recognized losses or take no- or low-cost gains in a lower taxable year

Generally Best Suited:

Lower than normal income year

When Should You Do It?

End of year when you have a solid estimate of your earnings for the year

Strategies for a Higher-Earning Year

Higher-income years often can be the result of a one-time liquidity event — whether it’s an abnormally large bonus at work or an influx of capital from the sale of an asset. There are two main strategies that can help lower your tax burden. Keep in mind, of course, you and your tax advisor or financial advisor should be sure these are appropriate for your personal situation.

1. Gifting

Charitable donations can be an extremely effective way to lower taxable income and help support causes you hold dear. And, as you’ll see, there are several advantageous strategies you could consider.

Cash Gifts

Charitable donations can be deducted against your adjusted gross income, pushing your tax bracket lower. This may impact your effective tax rate, and therefore could affect how much money you’re actually saving off your tax bill.

Eighty-seven percent of taxpayers take the standard deduction on their tax return, primarily because their home is either paid off, or other restrictions reduce the amount of write-offs available.5 But if you are able to itemize your deductions—with things like charitable donations, for instance—you may be able to push your tax bracket lower. For example, combined federal plus state tax rates can be upwards of 50% at the highest tax bracket. So if you can deduct your charitable gifts, every dollar you contribute to a charity could provide you a $0.50 tax benefit at that 50% tax bracket—a pretty good deal!

Conversely, the effective tax rate at the lowest bracket is roughly 10% (depending on state taxes), which means every dollar you contribute to a charity could provide you a $0.10 tax benefit—not as great a deal. So you see, it’s important to be mindful of how much you want to donate in order to lower your AGI, but to remain in the tax bracket that earns you the greatest benefit overall.

Let’s walk through a hypothetical example.

Sam and Veronica wish to make annual donations of 10% of their gross income— $27,500—to charity each year. Their Advisor suggested that bunching their gifts may make more sense. She ran the following analysis to show the impact.

Bunching Cash Gifts Example

| Scenario 1 | Scenario 2 | |||

|---|---|---|---|---|

| Year 1 Standard Deduction |

Year 2 Standard Deduction |

Year 1 $55,000 |

Year 2 Standard Deduction |

|

| Total Income | $275,000 | $275,000 | $275,000 | $275,000 |

| Charitable Contributions | ($27,500) | ($27,500) | ($55,000) | $0 |

| Applicable Deductions | ($27,700) | ($27,700) | ($55,000) | ($27,700) |

| Tax Paid | $46,152 | $46,152 | $39,600 | $46,152 |

| Taxes Paid Over Two Years | $92,304 | $85,752 | ||

| Effective Tax Rate Over Two Years* | 17% | 16% | ||

Tax Savings from Bunching: $6,552

Assumptions: Gross annual earnings for couple $275,000. Desired charitable contributions $27,500. Married filing jointly tax rate of 24%, graduated for income.

This example shows the potential benefits of lumping charitable gifts into one year rather than spreading them out over time.

- In Scenario 1, Sam and Veronica’s annual donation of $27,500 was less than the standard deduction of $27,700. As such, they took the standard deduction on their tax return each year, resulting in a two-year effective tax rate of 17%.

- Alternatively, in Scenario 2, Sam and Veronica’s gift of $55,000 exceeded the standard deduction in year 1, so they were able to write off the full amount on their taxes. In year 2, even though they did not make a charitable contribution, they were still able to take the standard deduction. Because of this bunching strategy, their two-year effective tax rate was 16%.

The result: While a 1% difference in tax rate seems minimal, Sam and Veronica saved $6,552 over the two years by bunching their gifts in one year. That's a 7.1% tax savings. And the charity still received the same amount, $55,000.

However, if they were concerned about the “lumpiness” of their gift, they could open and contribute the $50,000 to a donor-advised fund (DAF). That way they could benefit from a lower effective tax rate (Scenario 2) and distribute the funds from the DAF annually — a win-win.

Asset You Give Matters

There are also excellent tax advantages to consider for giving non-cash contributions.

Donating your stock

When you have a security that has appreciated considerably over a holding period of one year or more, you can donate that security to a charity, and receive a charitable income tax deduction for the security’s fair market value3, meaning you’re able to reduce your income and incur a lower tax bill as a result. In addition, when you donate an appreciated security you can avoid the capital gains tax you otherwise would have to pay if you sold the appreciated security.

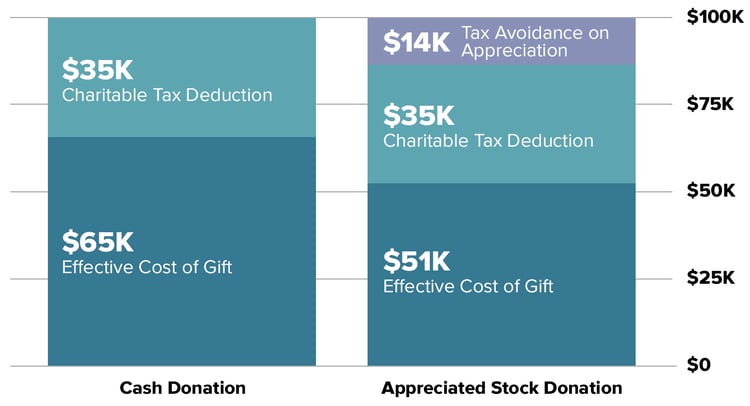

So how do you know if you should donate cash or an appreciated security? Gerald, in our next example, is facing this dilemma: He would like to make a donation to a charity in his mom’s name and is weighing the trade-off between giving cash or an appreciated security. Here’s the analysis his advisor showed him:

Tax Benefit of Cash vs. Stock Gift ($100K Gift)

For illustrative purposes only. Gift to qualified public charity. Federal tax rate: 35%. Long-term capital gains rate: 20%. Stock basis: 30%.

If Gerald makes a $100,000 cash donation, it could result in a charitable tax benefit of $35,000, effectively lowering the cost of the gift to $65,000. But by donating a security, Gerald can take the charitable tax deduction ($35,000) plus the benefit of not having to pay taxes on the stock’s appreciation ($14,000), for a total effective gift cost of ($51,000). And if Gerald still wanted to hold that security in his portfolio, because he transferred and did not sell it, he can use the $100,000 of cash he has set aside for a cash donation and repurchase the security immediately, thus resetting his cost basis.

Start a donor-advised fund (DAF)

As we mentioned with Sam and Veronica's example above, you can “bunch” several years’ worth of gifts into a single year to increase the tax benefits in the current year. But if you’re worried about making a significant gift this year followed by no assistance for the next few years, you can consider starting a donor-advised fund (DAF), which allows you to contribute assets to a tax-free account and get the tax deduction in the year of funding. Then you could direct the gifts to charities of your choice over the subsequent years.

Giving to family

Another gifting option is to give to family members. The beauty of this option is that

neither you nor your recipients pay taxes on the gift if you give an amount that is within the gift tax exclusion rules. And though you cannot deduct these gifts to lower your own tax bill, the ability to give money tax-free to people you are interested in helping is an annual benefit under the tax code. So, you may want to consider taking advantage of it each year.

The current annual gift tax exclusion is $17,000 per person ($34,000 per couple). This means you can give $17,000 to each person you want to, every year without worrying about taxes of any kind.

Any amount you give over that annual limit however, goes into a different bucket of money with different rules. The IRS gives us a tax exemption on gifts and estates over the course of our lifetime — this is called the lifetime gift tax exemption. The gift and estate tax exclusions and the generation-gifting transfer exemption stand at $12.92 million per person. Any amount you gift over the $17,000 per year gets deducted from this $12.92 million lifetime exemption. You don’t owe any taxes on it, but you do have to file a Form 709 to track it.

At the end of your lifetime, when you want to pass your estate on to your heirs, having gifted money throughout your life — both the $17,000 annual limit, as well as gifts over that limit up to the lifetime exemption amount of $12.92 million — reduce the value of your estate by that amount. And therefore, it could possibly reduce the estate tax for your heirs. You can take advantage of a prosperous year by helping family and friends, and benefit from lowering your future estate tax basis.

As you can imagine, there are certain rules and guidelines for how to employ a gifting strategy, which your financial or tax advisor can help you with.

What You Need to Know:

Supporting charities and/or your loved ones can ultimately reduce your tax burden

Strategy:

Gifting

What Is It?

Lower taxable income through donations of cash or appreciated securities. Bunching can increase the tax advantage. Gifts to family or friends can also reduce taxes

Generally Best Suited:

High-income year

When Should You Do It?

Before December 31. Leave time for assets to transfer during this busy time

2. Tax-Loss Harvesting

Tax-loss harvesting is the process of selling securities at a loss to offset a capital gains tax liability on investments previously sold for a gain. The asset sold is then replaced with a similar one to maintain the portfolio’s asset allocation and expected risk and return balance.

It’s important to note that investors cannot repurchase the security sold for a loss right away. That’s because the IRS’ wash-sale rules prevent taxpayers from selling or trading at a loss and buying the same stock or security — or a “substantially identical” one — within 30 days. Therefore, investors lose exposure to the sold security for a while. A typical solution is to replace it with a similar asset — such as a mutual fund or ETF.

Tax-loss harvesting only applies to taxable investment accounts. Retirement accounts such as IRAs and 401(k) accounts grow tax-deferred so they are not subject to capital gains taxes.

As a general rule, one usually employs tax-loss harvesting if the tax benefit outweighs the administrative cost. But if a loss is enough to offset a substantial gain, it may be worth it. And if there are remaining losses after wiping out the profits, you could potentially offset up to $3,000 of ordinary income. If you have losses that exceed the gain you counteracted and the $3,000, you can save those losses for subsequent years.

Here’s an example:

Patrick and Jasmine sold appreciated securities and recognized a gain of $10,000. However, instead of paying taxes on that gain, they decided to sell Stock Z, a pharmaceutical company in which they no longer had conviction and showed a loss of $13,000. But they still wanted exposure to pharmaceuticals, so they decided to buy a healthcare ETF to replace Stock Z. The result was a total offset of the $10,000 gain, plus they could reduce their income by the remaining $3,000 amount.

What You Need to Know:

Your portfolio’s unrealized losses can help lower a tax bill from portfolio gains

Strategy:

Tax-Loss Harvesting

What Is It?

Sell securities at a loss to offset a tax liability on investments previously sold for a gain

Generally Best Suited:

High-income year

When Should You Do It?

Towards the end of the year

Strategies Regardless of Income Earned

The concepts listed in this section are a bit different than the previous two.

Why? Because they shouldn’t be thought of as strategies you can take or leave. Rather we think of them as “realities” because unlike the strategies outlined so far, they should be considered at all earning levels.

For instance, Required Minimum Distributions are not a choice, but a mandate. And while you could choose to revisit your asset allocation, in reality it should not be an afterthought, but an integral part of evaluating your wealth plan.

Here we discuss four planning opportunities that should be a part of your annual review.

1. Required Minumum Distributions

Required minimum distributions (RMDs) are the least amount a retirement plan participant must withdraw annually starting the year they turn 73.4 RMD rules apply to all employer-sponsored retirement plans — such as 401(k) and 403(b) — as well as to traditional IRAs (but not Roth IRAs) and a few others. Taxes on withdrawn RMDs are at the account owner’s ordinary income tax rate.

They are mandatory. And if the participant doesn’t take it, there’s a stiff penalty. If an account owner fails to withdraw the full amount of an RMD by the deadline, the amount not extracted is taxed at 25% (or potentially 10%). Here’s Karen’s story:

At 75 years old and according to IRS tables, Karen must take a distribution of $15,000 from her IRA. She only takes a distribution of $10,000 this year and forgets to take the remaining portion. Karen is still obligated to “catch up” and take the additional $5,000 she missed last year, and now she also owes $1,250 to the IRS for her mistake.

And there are a few other considerations. For example, if an IRA owner has more than one IRA, the RMDs must be calculated separately for each. But account owners can withdraw the total amount from just one or several of them. The same is true for a 403(b) plan. On the other hand, RMDs required from different retirement plans — such as a 401(k) — must be taken separately.

There are some exceptions. In the event of an account owner’s death, a distribution of the entire balance of the participant’s account within 10 years for defined contribution plans or IRAs. There are exemptions for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person, or a person not more than 10 years younger than the employee or IRA account owner. This 10-year rule applies regardless of whether the participant dies before, on, or after the required beginning date, age 73.

What You Need to Know:

Skipping, forgetting, or short-changing your required annual withdrawal can lead to costly penalties

Strategy:

Required Minimum Distributions

What Is It?

Amount that a retirement plan participant must withdraw each year starting at age 73

Requirements & Limitations:

Required annually regardless of income

When Should You Do It?

Before December 31, but many brokerage accounts have an earlier deadline, some as soon as November 15.

2. Qualified Charitable Distributions

If you are taking RMDs and also making charitable contributions, a qualified charitable distribution (QCD) can be a more tax-efficient way to kill two birds with one stone.

A QCD is a nontaxable distribution made directly from a traditional IRA to a qualified charity. And good news — this distribution satisfies RMD requirements.

If it sounds like a bit of a hassle, consider that QCDs are widely considered to be the most tax-efficient way to give to charity. They often “beat” the common practice of donating appreciated stock, and are much more efficient than the standard approach of writing a check to your charity of choice.

The maximum annual exclusion for QCDs is $100,000. Any QCD above the $100,000

exclusion limit is included in income as any other distribution.5 There are specific IRS rules concerning deductible contributions and earnings.

Please consult with a qualified tax professional for guidance. Of particular note, many of the strategies in this document can be combined for supercharging your wealth plan, but you cannot use a QCD to fund a donor-advised fund.

What You Need to Know:

If you are taking RMDs and also making charitable contributions, a QCD can be a more tax-efficient way to kill two birds with one stone

Strategy:

Qualified Charitable Distributions

What Is It?

Nontaxable distribution from a traditional IRA made to a qualified charity that could satisfy RMDs

Requirements & Limitations:

This can be made annually but cannot exceed $100,000

When Should You Do It?

Before December 31

3. Changing Asset Allocation

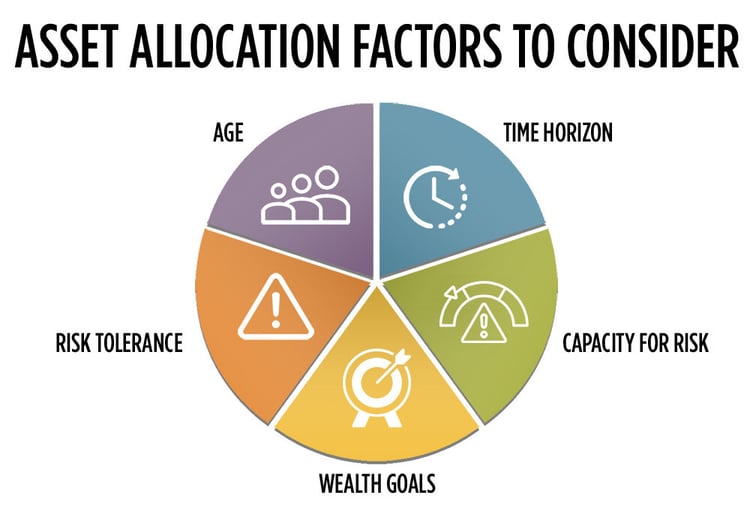

Year-end is a good time to re-evaluate your long-term wealth plan. Part of that assessment should look at whether your asset allocation is keeping you on track to meet your goals.

Asset allocation determines the percentage of each asset class in a portfolio. It allows investors to “balance out” the potential risks and returns to help them reach their wealth goals. This balancing act is essential because a too-risky portfolio may potentially deliver outsized returns and make it vulnerable to high volatility. On the other hand, a too-conservative portfolio may leave money on the table.

Asset allocation works because market conditions that create poor or average returns in one asset class may boost others. Therefore, a proper mix of asset classes may lower the volatility of investment returns without sacrificing potential gain. While this is important for all investors, it’s even more crucial in retirement when investors don’t have the time horizon or earnings to offset significant portfolio losses.

Is There Such a Thing as a “Right” Allocation?

Every person has a unique vision of life and how to live it, which influences spending and saving. That vision, in conjunction with other factors, should drive their unique optimal asset mix. So for you, the right allocation is the one you’ll stick with through market ups and downs, just like the best diet is the one you’ll stick with!

Typical allocations recommend a combination of several asset types to diversify portfolio risk. However, they also need to focus on meeting short-term expenses while growing assets for the future. This dual objective — to meet short- and long-term wealth expectations — is why some allocation models favor a higher weight in stocks than other asset classes.

The Fool Wealth Philosophy

We believe that one of the best paths to achieving long-term wealth for individuals at all life stages can be with stocks as the majority of your portfolio. Those in their earning years are trying to accumulate and grow assets for their future. At the same time, retirees need income to meet living expenses. But whether you’re far away from retirement, getting ready to take the plunge, or in retirement, don’t forget to account for inflation, which could eat away at a nest egg over the years. That’s why refining asset allocation regularly — at year-end, for example — is so important.

The Rebalancing Act

One of the benefits of having a team of Wealth Advisors and portfolio managers actively managing portfolios is the reassurance that an investment mix should remain within the optimal allocation. At times, the performance of some portfolio holdings may push the portfolio mix outside its targeted range. For example, say yours calls for 60% of your assets in stocks. Then suppose your investments have a great year — and your exposure balloons to 75% of your portfolio. You might want to slide some or all of that extra 15% into other asset classes — thus “rebalancing” your portfolio.

At other times, your wealth plan may shift. For example, sometimes new goals may be a focus, or your level of wealth may be significantly impacted by inheritance or liquidity events — like exercising stock options or selling a business. These examples may give rise to new financial objectives, which could necessitate a change to your asset allocation.

What You Need to Know:

A proper asset allocation is a vital component of helping you reach your wealth goals

Strategy:

Changes to asset allocation

What Is It?

Asset allocation balances risk and return through the selection of various asset classes in a portfolio

Requirements & Limitations:

Can be continuously tweaked. Should consider shifts in the key inputs to your wealth plan

When Should You Do It?

Anytime throughout the year

4. Maximize Annual Limits

The old adage, “Don’t leave money on the table” applies to year-end financial planning too. In particular, you should make sure you maximize the amount of savings and other benefits available every year. Here’s a list of the most common:

| Type | Dollar Limitation | Deadline |

|---|---|---|

| Retirement Plans | ||

| Elective deferrals for 401(k), 403(b) | $22,500 | Generally April 15 (Tax filing day) |

| Catch-up contribution | $7,500 | |

| Traditional or Roth IRA | $6,500 | Generally April 15 (Tax filing day) |

| Catch-up contribution | $1,000 | |

| Estate and Gift Tax | ||

| Annual gift tax exclusion per person | $17,000 | December 31 |

| Lifetime estate and gift tax basic exclsuion | $12,920,000 | |

| Health | ||

| Health savings account contribution max | $3,850 (single) $7,750 (family) |

At open enrollment each year |

| Catch-up contribution | $1,000 | |

| Flexible savings account contribution | $3,050 per year per employer | At open enrollment each year |

| Dependent care account contribution | $5,000 for the 2023 plan year | At open enrollment each year |

| Education | ||

| 529 Plans | Follow the gift tax limits above | |

Sources: College for Financial Planning, savingsforcollege.com. Data for 2023 tax year.

But don’t forget that your flexible spending or dependent care spending expires on December 31 — use it or lose it every year!

Your Wealth Plan Doesn't End December 31...

Wealth planning is a year-round endeavor. But the end of the year, and beginning of the next, present opportunities to explore tactical shifts that help further your financial objectives. These moves depend solely on your individual circumstances and goals.

For example, sometimes strategies that make sense for a friend don’t fit with your plan. Other times, maximizing wealth may not be your objective. Or a different set of factors may influence which tactics you should employ. The key is to understand your options, see how they may fit with your plan, and ensure you take advantage of them in a timely manner.

At Motley Fool Wealth Management, we take pride in tailoring our investment advice to your individual goals and needs and helping you pursue your idea of personal wealth.

How we work with you

With Fool Wealth, your money is held in an account that is solely yours—a separately managed account (SMA) — rather than in a pooled vehicle—like a mutual fund or ETF — with investors who may have different goals. In an SMA, you’re not at the mercy of other investors’ whims. So their actions — like pulling out money at inopportune times — can’t hurt your returns.

SMAs differ from a pooled fund in that the professional investment managers at Fool Wealth purchase securities in an account in your name — on behalf of you, the investor, not on behalf of the fund. This important distinction opens the window for possible advantages in terms of tax considerations or charitable giving, like we discuss in this report, as well as investment management, customization, and diversification.

Learn more about Fool Wealth, the investment services we offer, and how we can work with you year round to minimize your taxes and help you meet your wealth goals.

![]()

Footnotes

1 Earnings may be subject to taxes and penalties if withdrawn before age 59½ and before an account is five years old. Contributions can be taken anytime tax- and penalty-free.

2 ssa.gov, accessed Aug 30, 2022

3 A charitable tax deduction depends on what the donor itemizes on their taxes and is subject to the 30% of adjusted gross income limitation.

4 RMDs can otherwise be taken in the year in which the participant retires. However, suppose the retirement plan account is an IRA, or the account owner is a 5% business owner sponsoring the retirement plan. In that case, the RMDs must begin once the account holder is age 73, regardless of whether they are retired. For more details, go to irs.gov

5irs.gov, accessed Aug 2022

Let's see what we'd recommend for you

It all starts by filling out this form. It’s secure, and completely free. You’ll answer a few questions about your income level, time horizon, risk tolerance, and financial goals. Then we’ll provide a personalized asset allocation recommendation specifically for you.