To download this report as a printable PDF version, click here.

What does “real wealth” mean to you?

Many people automatically answer with a dollar sum—a million dollars—or ownership of an asset—a luxury yacht or a vacation home. Others have a vaguer definition: Wealth means having “more.”

But what does “more” mean? It may be an accumulation of assets or an abundance of time to spend doing something you love.

People don’t always deeply contemplate the answer. But when individuals consciously think about wealth, they realize it goes beyond the amount in their bank account or the number of possessions they own. Instead, many discover that the intention behind having wealth is about fulfilling a mission—achieving a goal or objective. It's about comparing the life they're currently living to the one they really want.

It starts with a Family Wealth Plan.

Uncovering your most important life aspirations is a key part of the wealth planning process. We frequently discuss hopes and desires with new and existing clients so we can create investment plans we think are best-suited to potentially bring those aspirations to life.

Notably, aspirational planning is not just for those with a six-figure bank account or individuals nearing retirement. Nor is it just for older generations. Families—with members of all ages—should get together and draw up a wealth plan together. And there’s no better time than during the holiday season, a family gathering, or a family meal to start.

Eat and Meet

Eat and Meet

Devising a family wealth plan should start with a family meeting.

We know, a family meeting might sound a little awkward or intense. And for some, it probably is. That's why planning a time to chat during a time the family is already gathering is a good idea. Not only does it solve the logistics of getting everyone in the same place, but holidays or other celebrations can hold a certain sense of joy that can ease tensions that often arise when discussing finances and other uncomfortable topics.

Plus, you can lure your loved ones with the promise of a delicious family meal!

Once everyone is gathered around, you can dive in.

How do you get started? These questions can serve as a guide.

What is the goal of your time together?

Gathering everyone together is an opportunity to accomplish many tasks. For example, do you want to spend your time together going through your family's monthly budget? Or do you want to look at long-range financial strategies, such as switching control of accounts or the family business? Maybe you'd like to use this opportunity to coalesce around a particular activity, such as volunteering opportunities. Below are three impactful goals you could consider for your family meeting:

- Financial literacy. We believe it's essential that children understand money and financial decisions. Financial literacy is critical in light of our school system's lack of financial education today. Only 70% of U.S. states require high school students to take a course in personal finance.1 But data show that when students receive financial education, they are more likely to borrow more sensibly by shifting from high-cost to low-cost financing. That can mean a lesser chance of finding themselves in overwhelming debt.

- Wealth transfer and legacy. Going hand-in-hand with financial literacy is a desire to discuss family wealth and prepare heirs for “wealth transfer," a seemingly stuffy phrase for a constructive conversation. Some families don't feel comfortable disclosing their assets—regardless of the level—while others are more concerned about divulging their plans for wealth transfer. But it's vital to prepare your heirs to take the reins—whether they'll need to run a family business or be good stewards of an inheritance.

- Charitable giving and philanthropy. Charitable giving also does not depend on how much money you may have. Instead, it's about important causes and how your family may want to support them. Sometimes the "how" will take the form of a donation, but it can also be about giving time through volunteerism or voice through petitioning or activism.

These are topics we find ourselves speaking about with clients all the time. That’s because one of the most important factors to consider when creating an investment plan is who or what the money is for.

Will you be making regular withdrawals to pay for monthly expenses? Will you be saving it to leave behind to your children or grandchildren? Or do you want to use your wealth right now to support a cause or an organization you care about? The answers to these questions can help inform what kinds of investment strategies you should consider and how aggressive you can potentially be with your investments, given your timeline.

Who should participate?

Family gatherings can be limited to immediate members or extended ones. You may also elect to have a minimum age—say high school or older. Or you may feel it’s important to start young and have everyone involved, even if they still struggle to pronounce the word “fiduciary.” As we said earlier, we believe that talking about wealth, financial decisions, and money trade-offs is important at every age.

Just like we don’t believe “just trust us” is a good policy for our clients, we think you should take the same approach with your family members. In other words, we strive to explain clearly the decisions we make within our clients' investment portfolios, so they better understand their financial circumstances. So even children who may not have a natural interest in finances can benefit from attending the family meeting and participating in the decision-making.

While essential for all ages, teaching financial literacy is not always easy. We recommend tailoring the concepts by age for better understanding. Here are some examples:

|

If your grade-schooler has a book fair at school, you can discuss the importance of staying within the $20 budget. They can also learn that they may need to account for sales taxes, so they can only spend $18 on books. |

|

Middle schoolers can take the concept broader to clothes shopping and using a credit card. “It’s not free money!” is a concept that everyone needs to learn. |

|

High schoolers and college-aged children who have a job can learn about budgeting, saving a portion of their earnings, and spending within their means. |

What are the most important discussion topics?

Once you agree on attendance and the overall goal of your meeting, it’s time to set an agenda.

For example, if it's around Thanksgiving, you could parlay the discussion of giving thanks to giving back. You may decide to use this family meeting as a discussion around philanthropy. Every member can have a voice on what matters to them and how they’d like to help.

If this is your first family huddle, it's also an opportune time to identify your family's mission, vision, and values. In other words, your "why."

What is a mission statement?

Most companies and organizations have a mission statement to describe their purpose and overall intention. It also supports their vision—the organization's ideal state. While the mission statement serves to communicate meaning and direction, the vision should be aspirational.

Part of the mission and vision is identifying the core principles that guide and direct the organization and its culture. These values create a moral compass that underpins decision-making and establishes a standard for assessing actions. Companies that can align their efforts, resources, and energy behind their mission, vision, and values tend to make stronger, faster, and more impactful progress toward their goals. It's a powerful tool that we believe individuals can benefit from as well.

What is Your Purpose?

What is Your Purpose?

Get started on your mission statement

Identifying your mission may be overwhelming. So instead of trying to think “big picture,” start small. We recommend reflecting on past experiences that felt fulfilling—whether it was a vacation, starting a business, raising money for charity, or tutoring. Then find the common threads in those experiences.

For example, if you received satisfaction from raising money for charity and tutoring at an underprivileged school, helping the disadvantaged might be your mission.

Or, if going on a vacation with your extended family gratifies you, your purpose may be to organize annual family gatherings to grow family cohesion.

Perhaps starting a business that promotes the performing arts is your heart’s desire. In that case, your mission could focus on supporting the arts in your community.

Your mission can be whatever fills your life with joy.

It’s human nature to want to know “why.” Why do we have to clean up? Why do we have to learn chemistry? Why should we wear sunscreen? If the “why” resonates with you, you’ll likely follow through. But if it’s not something you identify with, then you’ll probably ignore it or simply forget about it.

The same can be true about saving and building wealth.

Consider this real-life perspective from financial columnist Brian Stoffel. Brian worked for five years as a public school teacher in Washington, D.C., before turning his attention toward financial education, writing extensively for The Motley Fool (the parent company of Motley Fool Wealth Management) over the last decades. He has put many of the techniques included in this guide into practice in his own life.

Over a decade ago, my wife and I taught at different inner-city charter schools in Washington, D.C. They both catered to low-income, predominantly minority populations. The similarities ended there. Mine was strict and regimented with long (10-hour) school days. Hers was more free-flowing, open, and focused on "experiential learning."

On paper, we’re both fans of the approach at my wife’s school. But in reality, my school primarily flourished while hers floundered. Many nights, we would discuss why this might be the case. Then, one night, over pizza, it hit my wife.

At my school, we had a clear mission: "to get students to and through college." Everything we did—from the names of our homerooms to completely revamping our writing curriculum—was in service to this mission.

No such dictum existed at her school. And if it did, it was just given lip service. Without that compass, it probably was difficult to make critical school-wide decisions.

It wasn't that "regimented" was better than "experiential." It was that one school did not doubt the why—we knew exactly why we existed. The other school didn’t.

Around the same time, my wife and I met with a financial planner. Her first question was a doozy: "So what do you guys really want?" We figured this was a money question: What types of stocks do we want to buy, or when do we plan on buying a home?

But no— it was much deeper: What did we want...from life?! We didn't have an answer. We didn't know that we were allowed to even think about it. So we took our time and—reflecting on our teaching experiences—decided we needed to develop a mission statement. We needed our “why.”

How do you do that? We googled and read as many different stories as we could. But, unfortunately, that didn't provide any lasting answers. Instead, we tried out various statements; we evaluated how well they helped guide our decisions; tried to discern how it made us feel; and adjusted.

It took over five years until we found a mission statement that resonated: "To nurture meaningful relationships." So that's where we've landed. We may adjust our mission statement in the future, but it's lasted longer than any other we've tried so far.

What does this have to do with financial planning and wealth management? Everything!

When our family makes a financial decision, we ask ourselves: “How will this affect our ability to nurture meaningful relationships?” Without such a compass, I have little doubt that this would have been filled in—even implicitly—by the messages around us. When it comes to finances, our “why” could just as easily have been: “To be as successful and wealthy as possible.”

A notable example of the effect of a clear mission: When the pandemic hit, we were stuck at home with a six- and one-year-old. Balancing work responsibilities, our daughter's remote learning, and the fundamental inability to get outside took its toll.

At the same time, the number of writing opportunities coming through for me was surprisingly increasing. If I was willing to put in the same amount of time as usual, there was a chance for larger paydays. It was enticing—I could feel the pull to "maximize our income."

But what would that have meant for our relationships? My best guess? It would have been very unhealthy. Instead, I significantly pared back my writing to a point where we could achieve sustainability—in our lived experience and finances.

The takeaway is simple: If we aren't careful, we can start to believe we exist to serve our finances. In a life well-lived, it's the exact opposite: Our finances exist to benefit us.

But what does "benefit us" mean? It's a different answer for everyone. For me, it's nurturing meaningful relationships. For you, it might be something entirely different. Wrestling with the question is the price of admittance to an aligned life. It's a struggle that—decades from now—you'll be glad you made.

Creating YOUR Family Mission Statement

Creating YOUR Family Mission Statement

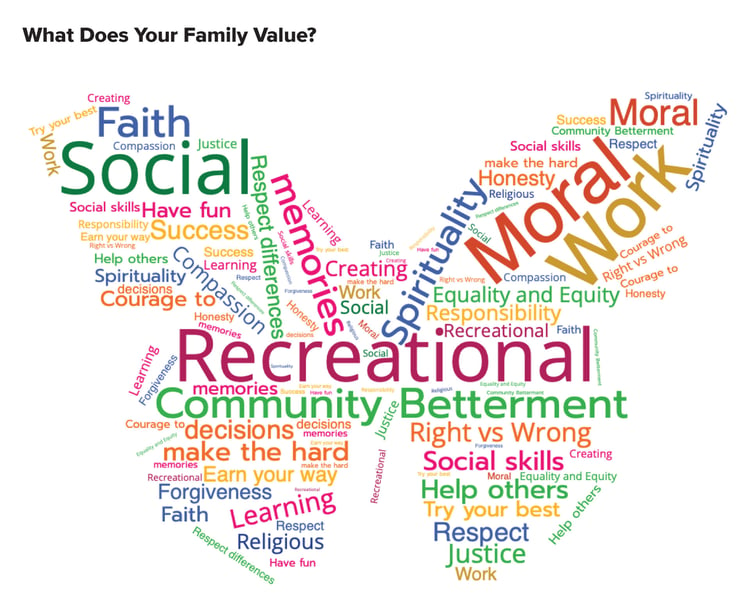

How do you identify your values?

Family principles and beliefs are the core ideals upon which each member conducts their lives. But, of course, there are many different values, and no one belief is better or more right than another. It’s all about what is inherently part of your being and your aspirations.

Unfortunately, no one can tell you what your philosophies are or what they should be. Identifying your own core ideals requires a profound internal discovery and discussions with your loved ones.

What about you? Do you know how you want to prioritize the different aspects of your family’s life to benefit you?

Then you might be ready to start your mission statement and formally acknowledge your aims and values. Or maybe you're not ready to voice your family’s “why." Getting started is not easy for many, which seems weird because it’s about your values and goals. But taking an introspective view is not something many people do.

Your family meeting can focus solely on each member's values and goals. For instance, you may value happiness while your spouse values job success. Your daughter may feel strongly about social justice. At the same time, helping animals is your son's passion.

After articulating your values, focus on how to achieve them. Coming to an agreement is the basis behind creating the family mission statement.

Alongside values and goals, your family should consider your desired lifestyle. How do you want to live? Is creating generational wealth a focus, or would you instead gift surplus wealth to charity?

The answers to these questions can majorly impact how you invest and allocate your assets. You may want to stash what you’ve saved in the relative safety of a conservative asset allocation. Or, if you have a longer timeline—perhaps one that even extends beyond your lifetime—you may opt for a more aggressive growth strategy.

Bill and Melinda Gates and Warren Buffett conceived the Giving Pledge on this notion. Created in August 2010, "40 of America's wealthiest people joined together in a commitment to give the majority of their wealth to address some of society’s most pressing problems.... It is inspired by the example set by millions of people at all income levels who give generously—and often at great personal sacrifice—to make the world better.”2 So while you may not be a billionaire or a millionaire, the concept is still the same—to give away the majority of your wealth after accounting for living expenses to help make the world better.

There’s no one-size-fits-all answer, but knowing what mission you’ve set out to accomplish can help guide your family’s financial strategy, even if you pivot along the way.

Coming back to the real-life perspective from financial columnist Brian Stoffel, his “why” really mattered in the face of a personal tragedy.

My 95-year-old grandma recently passed away. Because my mom’s mom died long before I was born, this was the only grandma I ever knew.

From the time I was in middle school, we had a special connection. I still remember my grandma crying when I left for college. But, on the other hand, she was so excited to see me when I came home for Thanksgiving that she couldn't unlock the latch on her front door fast enough to hug me.

I moved back to Wisconsin with my family seven years ago. Every Friday, my daughter and I would join my grandma at her salon down the street. We would chat; my daughter would run around pretending to run a restaurant, taking orders from the other patrons. As a joke, the older women would order hard liquor—to which my daughter happily obliged.

From when I was a kid, Sunday afternoons meant gathering at her house to watch the Brewers or the Packers. We take our sports (perhaps too) seriously—and some of my best memories are of sharing the triumphs and crushing defeats...together. So when the Packers won the Super Bowl years ago, I called her from Costa Rica so we could bathe in that joy together.

And then 2020 rolled around. Our visits were mostly confined to us gathering on my grandma’s porch while she was safely on the other side of the screen. Her health started failing rapidly, and she died in July of that year.

In this context, I think about any investing success and think: “Who cares? I just lost my grandma.” It would be easy to take these circumstances and conclude: “Life sucks.”

But I don't think either of those conclusions does justice to how life works. When we build context around what matters to us, we give meaning to all these things—our relationships and our investments.

Here's what I mean: From our professional experiences as teachers, my wife and I have long believed that mission statements are paramount. But we didn't have one for our personal lives. So we set out to change that. It wasn't easy, but we eventually settled on ours of nurturing meaningful relationships. I can say with absolute confidence that my investments serve that purpose.

How?

Without such a mission, I would’ve thought twice about taking two hours every Friday morning to hang out at a salon with my daughter and a bunch of 90-year-old women.

Or consider the unprecedented impact of COVID-19: I was able to significantly reduce my writing to help keep sanity in a house with two young kids under quarantine. Of course, the decision meant making less money, but because “maximizing money” isn’t front and center, I could shift—sustainably—in a way that puts the most value on our family relationships.

The “How” of Fulfilling Your Family Mission

The “How” of Fulfilling Your Family Mission

Once you’ve established your "why," it's time to figure out the “how.”

A part of your mission may only require your time or voice. Volunteerism is one of the best ways to get the whole family involved and learn valuable lessons about commitment, giving back, teamwork, compassion, and empathy, among others. Or standing up for those who can’t fight for themselves by speaking out or starting a petition. Encourage your children to stand up to bullies or run for student government so they can positively impact the lives of their peers.

These are all great endeavors, but most elements of your mission may require some good, old-fashioned moolah to bring them to fruition.

And for that, you’ll need a solid financial plan.

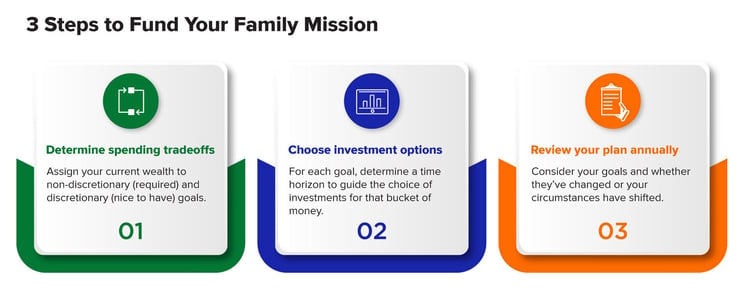

These three steps can pave the way to accomplishing your family’s mission:

1. Determine spending tradeoffs.

What is your family's collective goal? Determine what's necessary and what you can do without. Once you decide your willing tradeoffs, assign your current wealth to non-discretionary (required) and discretionary (nice to have) goals.

This may result in different investment plans for each "bucket." For example, suppose you have $3 million saved. In that case, you may assign $2 million to overall retirement and the remainder to other goals such as legacy gifts, charitable giving, starting a business, or even more aggressive investing.

2. Choose your investment options.

Each bucket’s goal should have a specific time horizon. For example, if your family has a long-term philanthropic plan or wants to build generational wealth, earmark funds for growth. This bucket will likely invest primarily in stocks. Because as students of history, we’ve long believed that stock investing is one of the time-tested paths to building long-term wealth.

For this reason, individual stocks of quality companies often form the foundation for the majority of our clients’ portfolios. We believe this approach can be less risky than many would have you believe and can potentially better position you to achieve those long-term goals.

Within the world of stock investing, strategies fall along a spectrum of risk—from those focusing on income-generating, stable companies to those targeting up-and-coming, high-growth companies. And among the growth spectrum, the size of the company differs.

Large-cap stocks are generally considered "less risky," as they typically have more money and resources at their disposal than small-cap stocks. Small-cap stocks often have more growth potential but carry more embedded risk.

The most comfortable allocation can depend on your personal goals, timeline, and ability to accept risk in your account. In the end, a favorable allocation for this particular bucket may consist of various stock strategies combined with other asset classes—like less liquid securities or alternative investments, such as hedge funds, if eligible—to drive overall portfolio growth.

3. Review your plan annually.

Consider your goals and whether your circumstances have changed. For example, suppose you experience a liquidity event—like selling a business or receiving a significant bonus. In that case, it may make more sense to start a donor-advised fund (DAF) for charitable giving to lower your tax basis in the year of your liquidity event. Bunching your donations in a DAF may help offset a high tax burden and allow you to fund your charitable endeavors for years to come.

Life Without Regret

Life Without Regret

You may have spent years saving money, but do you know what you were saving for? Unfortunately, without a future vision tailored toward your mission, you may not be able to answer that question. Because achieving real "wealth" looks different for everyone.

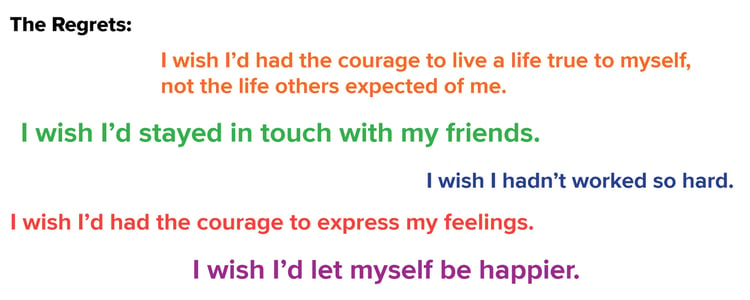

In her best-selling book, The 5 Regrets of the Dying, author Bonnie Ware, an Australian palliative care nurse, talks about what she saw as her patients passed through their final moments.

Later, Ware writes, “None of the life reviews I witnessed from the side of deathbeds included the wish that they had bought or owned more, not even one. Instead, what most occupied the thoughts of dying people were how they lived their lives, what they did, and whether they had made a positive difference to those they left behind.”

Few people step back and examine the “why." Many jump right to the “how." But we believe the “why” can help individuals live a life true to themselves.

Perhaps that means doing something costly, like traveling the world. Maybe it’s something that requires no money at all—like volunteering. Most likely, it’s somewhere in between. “True to yourself” will be different for everyone—and that’s a beautiful thing.

Footnotes

1 Council for Economic Education.

August 2024. Accessed October 2025.

2 The Giving Pledge. Accessed October 2025.

Join our email list for updates

Stay in touch by signing up for our weekly newsletter. You’ll be the first to hear the latest updates about Fool Wealth’s transition to Apollon, plus fresh insights on investing and financial planning.