If you recently decided to start saving for retirement or are fine-tuning your approach, congratulations on making such a smart money move! Not only are you taking the necessary steps to ensure the kind of retirement you are hoping for, you’re also doing a favor for the people you care about—even if they don’t know it yet.

Having a smart retirement savings plan should help make you more financially secure later in life and likely more independent, healthy, and happy. In addition, this can take a lot of work and worry off the backs of your spouse, kids, siblings, and friends.

The “Report on the Economic Well-being of U.S. Households” from the Federal Reserve indicates that although Social Security is the most common source of income in retirement, 81% of retirees ALSO had one or more sources of private income.

So, how should you build up savings for that future day when you’re no longer working and need a substantial nest egg to supplement Social Security and provide a steady income stream? This is an important question—whether you’re 28, 42, or 55. And there is an impressive variety of saving and investment options from which to choose.

Let's start with what they all have in common

Employer-sponsored retirement accounts—such as 401(k)s—traditional IRAs, and Roth IRAs are the most popular investment accounts in which to build retirement savings, and for good reason. Used properly, they can help develop large retirement war chests over a lifespan.

There are several advantages these retirement accounts have in common.

- First, all offer potential tax benefits compared to investing in a regular brokerage account.

- Second, they incentivize holding the money until you retire (otherwise, you'll pay the penalty for an early withdrawal).

- Finally, and perhaps most importantly, they make it easy to save for retirement.

But in other ways, they are different. And knowing these differences can significantly affect how much you save.

In this report we share what your options are and how each works, how to evaluate the options to determine which are right for you, helpful examples to illustrate differences in tax consequences, important information about contributions, an easy-reference comparison chart, and more! But as with any discussion related to taxes or estates, you should always seek counsel from a qualified tax or legal professional.

Employer-Sponsored Retirement Accounts

Employer-Sponsored Retirement Accounts

Employers offer retirement plans to encourage their employees to save for the future. There are two types: defined benefit, such as pension funds, and defined contribution, which includes 401(k), Thrift Savings Plan (TSP), and 403(b).

How do defined benefit (pension) plans work?

Defined benefit (DB) plans offer employees a stated, guaranteed benefit. Ensuring the plan can pay out that benefit is the sole liability of the employer; in other words, the employer assumes all the risk, not the plan participant (you, the employee). That means the employer contributes to the plan and manages the investment portion that generates the returns needed to pay the plan participants. The employee does not select the investments. Generally, employees don’t contribute, either. After a period of working for the company—called the vesting period, which is usually around seven years to be 100% vested—the employee is guaranteed a benefit paid each month at retirement. The amount received is typically linked to an employee’s salary, age, and length of employment with a company.

Payments begin based on the plan guidelines—usually around age 60 or soon after—and stop or transfer to a spouse (potentially at a reduced benefit) upon the participant’s death.

Defined benefit plans have largely gone by the wayside. While they remain active for many public employees—like government workers, teachers, and fire and police systems—most corporate plans are winding down and no longer provide the benefit to new employees. Instead, many employers offer a defined contribution plan.

How much is your pension worth?

If you expect to receive a pension from your current or a past employer, contact the company's human resources department offering the plan or the plan administrator to get an estimate of your benefit.

They should provide a "Summary Plan Description" to detail how much your pension is worth and explain the plan's claim procedures. And to see your specific benefit, request a statement from the plan provider.

Even though your benefit doesn't change over time, the success of the pension plan is still dependent on the plan's funding levels and how it achieves the investment growth required to pay your benefit.

If you work for a public company, you can check to see how healthy your pension fund is by reviewing the company's publicly available annual report.

According to a study conducted by the consulting and actuarial firm Milliman, the average corporate pension funding ratio was 99.6% in 2021, up from 87.5% in 2020 and the closest to being fully funded since 2008.*

Another recent study calculated that the average rate of return required by corporate plans to reach full funding status in 10 years (the hurdle rate) is 5.5%. The expected return for 70% of plans is aligned with this hurdle rate, but 30% have a "misaligned investment strategy and end-state objectives. Approximately 17% of plans may be taking on more risk, while approximately 13% of plans may be taking too little risk than is required to meet their objectives."+

It is important to understand your plan's funding status because since many are below their funding requirements, they may not be able to pay out benefits as promised. Guaranteed benefits are not the same as risk-free!

*Pension Funding Index January 2022, Milliman, January 12, 2022

+Blackrock, Corporate Pensions: Improved funding ratios, but still hard at work, 2021.

How do defined contribution (401(k)) plans work?

Defined contribution (DC) plans do not offer a specific or stated benefit amount—it all depends on how much the participant (that’s you) contributed and how the money was invested and grew over time.

Unlike in a DB plan, employees have a lot of responsibility within a DC plan. The employee:

- determines how much to contribute annually to the plan. However, the IRS established a maximum limit that one can contribute: In 2023, that maximum is $22,500 (or $30,000 if you are at least 50 years old).

- selects investments from the lineup provided by the employer. Many employers offer tools and resources to aid in this process. But the risk is solely held by you, the participant, and not the employer.

- periodically reviews and adjusts the investment allocation to ensure retirement savings are on track. In addition, an investment statement can help clarify contributions and the balance of the account.

You CAN begin withdrawals at age 59½ without incurring early withdrawal penalties, but you are generally REQUIRED to start taking distributions by age 73—known as the required minimum distribution (RMD). Click here for more on RMDs.

Defined contribution plan assets are owned and controlled by you, the participant. Any assets remaining upon your death will pass to the account beneficiaries that you designated.

SECURE Act 2.0

In 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed into law to help improve retirement savings for American workers. In December 2022, the Consolidated Appropriations Act was passed. Here are some of the major changes for retirement savings:

1. Increased the age for RMDs from 72 to 73 starting on January 1, 2023, then to 75 starting in 2033. The increase in age would allow Americans to save for retirement longer.

2. Higher catch-up amount for workers who are ages 60-64. The proposed catch-up for a 401(k) and 403(b) would rise to the greater of $10,000 or 150% of the regular catch-up contribution amount for 2024 and for a SIMPLE IRA, to the greater of $5,000 or 150% amount for 2025. These limits would then be indexed for inflation every year.

3. Eliminates RMDs for Roth accounts in qualified employer plans beginning in 2024.

4. Allows SIMPLE IRAs and SEP IRAs to accept Roth contributions.

5. Allows employers to deposit matching or non-elective contributions to employees’ Roth accounts (in a 401(k) or 403(b) plan).

6. High-income earners (income greater than $145K) must contribute catch-up monies for a 401(k), 403(b), and 457(b) to a Roth starting in 2024. (Catch-up contributions for IRAs are not required to go into a Roth.).

7. New surviving spouse benefits when taking RMDs.

8. Catch-up contributions for IRAs and 401(k) will adjust for inflation starting in 2024.

9. Annual qualified charitable distribution (QCD) amount will be indexed for inflation. Also offers a one-time opportunity to use a QCD to fund various charitable trusts or annuities such as CRUT, CRAT, or CGA.

10. Employers can match based on student loan repayment.

The 411 on contributions

If you sign up for your company’s 401(k) program, it will take automatic pre-tax deductions from your paycheck (you choose the amount), put the money into your personal 401(k) account, and invest the money according to your investment selections. Most offer various investment options, from conservative to aggressive, to fit your comfort level. The service may also come with investment advice.

Companies may also offer "matching contributions" up to a certain amount, such as 2%–4% of your salary. This benefit is like “free money.”

For example, if you are making $75,000, a 4% annual contribution to your 401(k) account is $3,000 of free money per year. Over 30 years, that is $90,000 in free contributions. And, these company contributions could grow significantly depending on how you invest over several decades.

How much? If the $3,000 was invested each year in a moderately conservative portfolio consisting equally of stocks and bonds that produced an average annual return of 6%, then after 30 years, that free money could be worth $237,174. Not a bad haul!

| The Glorious Effects of Compounding | |

|---|---|

| Starting Balance: | $0 |

| Time Invested: | 30 Years |

| Annual Rate of Return: | 6% |

| Annual Contribution: | $3,000 |

| Results | |

|---|---|

| Total Contributions: | $90,000 |

| Total Growth: | $147,147 |

| End Balance: | $237,147 |

And this doesn’t even include your contributions. Since these are matches, adding both together could produce a substantial nest egg.

Besides the opportunity to take advantage of compounding growth, there's another benefit when you contribute to a DC plan—tax deferral. In other words, you don't have to pay income taxes on the money you contribute at the time you earn it. But here's a critical distinction: The money taken from your paycheck and added to your 401(k) is not tax-free. Instead, it is tax-deferred. You pay no income tax until you withdraw it from your 401(k), which should not be until retirement.

The potential advantage of tax deferral is that most people are in a lower income tax bracket in retirement than in their earning years. So by deferring tax payments until retirement, you can possibly pay a lower tax rate on your accrued savings.

How substantial is this tax savings? Let’s say your total retirement contributions over your career are $500,000. While working, your average tax rate is 25%. And in retirement, your income could be much lower, so your average tax rate could be 15%.

If you don’t put this money in a tax-deferred vehicle like a 401(k), you will pay $125,000 in taxes on that $500,000.

If, instead, you put that money into your tax-deferred 401(k) and delay paying income tax on it until you withdraw the money in retirement, you will pay only $75,000 in taxes on these contributions, for a potential savings of $50,000.

Now, you know Uncle Sam isn’t going to let you defer paying your taxes forever! That’s why there are required minimum distributions (RMDs)—this is a legal requirement that you must take distributions from your 401(k) account each year starting at age 73. So even if you don’t need the money to supplement your retirement income, you must take it (or suffer a penalty of up to 25%) and pay taxes on the withdrawals.

And the only way around this is to still be working. If you are still working, you may not have to take RMDs (unless you own more than 5% of the company).

| What You Need to Know: Defined Contribution | |

|---|---|

| 2023 Contribution Limit | $22,500 ($30,000 age 50 or older) |

| Contributed Money Type | Pre-tax |

| Contribution Time Frame | Within the tax year. Ends December 31. |

| Earliest Withdrawal Age | 59½. 10% penalty if you withdraw early. Some plans allow penalty-free withdrawal at age 55 for early retirees. |

| Required Minimum Distribution | Age 73 unless still working. |

| When Taxes Are Paid | Upon withdrawal |

| Who Should Consider a 401(k)? | Every working person with access to a plan should take advantage of the tax-deferred growth potential. Starting early in a career and contributing the maximum amount are the best ways to grow retirement savings. |

Required Minimum Distributions

Required Minimum Distributions (RMDs) are the least amount that a retirement plan participant must withdraw annually starting the year they turn 73. RMD rules apply to all employer-sponsored retirement plans—such as 401(k) and 403(b)—as well as to traditional IRAs (but not Roth IRAs) and a few others.

Taxes on withdrawn RMDs are at the account owner's ordinary income tax rate at the time of the withdrawal. And if the participant doesn't take it, there's a stiff penalty. For example, suppose an account owner fails to withdraw the total amount of an RMD by the deadline. In that case, the amount not extracted is taxed at 25%.

Here's Karen's story: At 75 years old and according to IRS tables, Karen must take a distribution of $15,000 from her IRA. She only takes $10,000 this year and forgets to take the remaining portion. Karen is still obligated to "catch up" and take the additional $5,000 she missed last year, and now she also owes $1,250 to the IRS for her mistake.

And there are a few other considerations. For example, if an IRA owner has more than one IRA, the RMDs must be calculated separately. But account owners can withdraw the total amount from just one or several. The same is true for a 403(b) plan. On the other hand, RMDs required from different retirement plans—such as a 401(k)—have to be taken separately.

In the event of an account owner’s death, the entire balance of the participant’s account must be distributed within 10 years of the death for defined contribution plans or IRAs. There are exemptions for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person, or a person not more than 10 years younger than the employee or IRA account owner. This 10-year rule applies regardless of whether the participant dies before, on, or after the required beginning date, age 73.

What could you do if you don't need the RMDs? If you make charitable contributions, you could kill two birds with one stone by making a qualified charitable distribution (QCD). A QCD is a nontaxable distribution made directly from a traditional IRA to a qualified charity. And good news—this distribution satisfies RMD requirements.

If it sounds like a bit of a hassle, consider that QCDs are widely considered to be the most tax-efficient way to give to charity. They often“beat” the common practice of donating appreciated stock, and they're much more efficient than the standard approach of writing a check to your charity of choice.

Individual Retirement Accounts

Individual Retirement Accounts

Individuals who don’t have access to an employer-sponsored retirement plan can also save for their post-working years and receive a tax benefit. Even those with an employer-sponsored plan may be able save additional money. The most common way is through an individual retirement account (IRA).

Like with a DC plan, when you get started early—and make yearly contributions (up to the allowable IRA income limits)—you'll likely be in a better position. Because your money will have the chance to compound and grow for as long as possible before you need it.

Can my non-working spouse contribute to an IRA?

Even if you don't have any taxable income, you can contribute to an IRA. But there are a few eligibility requirements: First, you need to file a joint tax return. Second, your spouse needs to have taxable income. Third, while each spouse can make a contribution up to $6,500 ($7,500 if over age 50), the total of both of your contributions cannot be more than the taxable income reported on your tax return. The benefit: If neither of you participated in an employer-sponsored retirement plan, these contributions will be tax deductible.

An IRA gives you considerable flexibility with your investment options because you can invest in various assets, such as mutual funds, exchange-traded funds (ETFs), and individual stocks or bonds.

There are two main types of IRAs—traditional and Roth—and each has different eligibility rules and tax advantages.

How do traditional IRAs work?

Traditional IRAs are similar to 401(k)s in that the money invested is tax-deferred until it is withdrawn in retirement. How much can you contribute to a traditional IRA in 2023? Up to $6,500 per year if under age 50, and up to $7,500 if over 50—much less than a 401(k).

It works like this: You transfer money from your personal funds into the IRA after opening an IRA brokerage account. This money has already been taxed. So how do you get the tax deferral? First, you must claim and deduct the contribution on your tax return. Then years later, when you withdraw the money during retirement, you pay income tax on the withdrawn amount.

And like with 401(k)s, traditional IRAs force you to take required minimum distributions (RMDs) each year. However, unlike the “working exemption” with the 401(k), there’s no way around taking RMDs with a traditional IRA. So, again, you must take it (or be heavily penalized) every year starting at age 73 and pay taxes on the withdrawals.

| What You Need to Know: Traditional IRA | |

|---|---|

| 2023 Contribution Limit | $6,500 ($7,500 age 50 or older) |

| Contributed Money Type | After-tax but then take a tax deduction. |

| Contribution Time Frame | Anytime in the tax year through Tax Day of the following year. |

| Earliest Withdrawal Age | 59½. |

| Required Minimum Distribution | Age 73 |

| When Taxes Are Paid | Upon withdrawal |

| Who Should Consider a Traditional IRA? | You have earned income without access to a 401(k) plan with an employer, or you want to supplement an existing workplace retirement plan. You are seeking a tax deduction and tax-deferred growth. You think your tax rate will be lower in retirement. |

How do Roth IRAs work?

Similar to traditional IRAs, Roth IRAs have the same allowable annual contribution amounts—up to $6,500 per year if under age 50, and up to $7,500 if over 50—and they are opened and operated in the same way.

The big difference is the tax treatment: Roths are not tax-deferred. You contribute after-tax money and you cannot take a deduction on your tax return for your contribution like you can with the traditional IRA. But they offer tax-free growth. When you withdraw your money in retirement, you pay no tax.

Roth IRAs allow you to withdraw your contributions after five years with no penalty. However, the growth from these contributions—what you earned on the money you contributed—will incur a 10% penalty if withdrawn before 59½.

One of the biggest differences of Roth IRAs, besides the tax treatment, is that you are not required to take RMDs.

This means that if you don't need to withdraw funds throughout your retirement, you can potentially leave your beneficiaries a sizable, tax-free inheritance. Yup, they'll never have to pay any tax on this money either!

So, what’s the catch? Not everyone is eligible to make contributions to a Roth IRA. To qualify, an individual's modified adjusted gross income (MAGI) must be below certain thresholds. (Consult with a professional advisor to determine your eligibility.)

| What You Need to Know: Roth IRA | |

|---|---|

| 2023 Contribution Limit | $6,500 ($7,500 age 50 or older) |

| Contributed Money Type | After-tax. No tax deduction on contributions. |

| Contribution Time Frame | Anytime in the tax year through Tax Day of the following year. |

| Earliest Withdrawal Age | You can withdraw contributions after five years, but earnings can only be withdrawn starting at age 59½. Early withdrawal of earnings incurs a 10% penalty. |

| Required Minimum Distribution | None |

| When Taxes Are Paid | You have no additional taxes since you are contributing after-tax money. Therefore, earnings accumulate and are withdrawn tax-free. |

| Who Should Consider a Roth IRA? | You have earned income and want to accumulate tax-free retirement funds. You are in a lower tax bracket now than you expect to be later in your career or retirement. For millennials and other young investors, that can mean decades of tax-free growth and tax-free income during retirement. You want to leave your beneficiaries a potentially tax-free inheritance. |

Which should you choose: a traditional or Roth IRA?

The distinctions between a traditional IRA and a Roth IRA are often hard to understand. For example, while the annual contribution limits are the same, the Roth IRA withdrawal rules differ from those for a traditional IRA. This table shows several of the main differences.

| Traditional IRA | Roth IRA | |

|---|---|---|

| Mandatory Withdrawals | By April of the year after reaching age 73 | None |

| Taxes on Withdrawn Funds | Individuals may incur a tax and penalty by withdrawing money before age 59½ | Contributions can be withdrawn after five years tax- and penalty-free. Earnings can be withdrawn at age 59½. Early withdrawal of earnings incurs a 10% penalty.*** |

| Estate Planning | Similar rules apply to heirs that applied to original owner* | Can provide tax-efficient inheritance* |

| Distribution Period on Inherited Assets | Spouse:** Can stretch over lifetime Non-spouse: Most are required to take all distributions within 10 years of original owner’s death | There are no RMDs during original account owner's life, but inherited assets need to be distributed over 10 years |

| Taxes on Inherited Assets | Taxed at beneficiary’s tax rate | Not taxed |

*For specific rules on inherited traditional and Roth IRAs, see https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary.

**In addition to spouses, minor children, beneficiaries less than 10 years younger than original owner, and disabled beneficiaries can also stretch distributions over their lifetime. Source: IRS.

*** Growth is subject to a penalty depending on your age and how long the account has been held. Other criteria may allow growth to be withdrawn penalty-free. Contact your tax advisor for details.

Switching Among 401(k)s, Traditional IRAs, and Roth IRAs

Switching Among 401(k)s, Traditional IRAs, and Roth IRAs

There are also ways to shift assets from one type of account to another. For example, if you leave an employer, you may roll over your old 401(k) into your new 401(k) if allowed or to an IRA to consolidate your assets. Or you may contribute to a traditional IRA, then convert it to a Roth via a “backdoor” conversion. There are many advantages to doing these financial maneuvers, and we’ll cover each of them below.

- 401(k) rollover: Consolidate accounts and gain the opportunity for more customized investment choices and possibly lower costs.

- Partial conversion: You can convert all or part of an existing retirement account, such as a 401(k) or a traditional IRA, into a Roth IRA.

- Backdoor Roth: Transfer money from a traditional to a Roth.

Should you roll over your old 401(k)?

Have you transitioned to a new employer and left your 401(k) behind? Regardless if it has a few hundred or a few million dollars, you need to decide what to do with the funds. Unfortunately, many people don't know their options.

We’ve identified several potential solutions for managing 401(k) assets that remain in a former employer’s retirement plan.

Several factors may impact which choice might be best for you, including the investment lineup (what investments you can invest in), fees (administrative and other), and ease of keeping track of the assets (knowing where all your retirement assets are and how much they are worth).

So, consider each of these money moves:

- Keep it with the former employer. If you are comfortable with the investment options and are pleased with the performance and fees, it might make sense to keep your retirement account invested in your previous employer’s plan. Tax implications: None since funds remain in plan. However, some plans kick out participants with low balances.

- Rollover into an IRA. Many people choose to roll over their old 401(k) into an IRA in order to consolidate accounts into one investment account. Additionally, IRAs may offer broader investment choices and/or lower costs. Tax implications: Rollovers are tax-free.

- Rollover into a new employer's plan. Depending on your retirement plan’s rules, you may be able to roll over your old 401(k) into your current employer’s plan. This will consolidate the assets and consistently invest them with your current asset allocation. Tax implications: Rollovers are tax-free.

- Cash out. Some individuals decide to withdraw their retirement savings altogether. But if you cash out before age 59½, you will have to pay taxes on your entire withdrawal. In addition, the IRS takes out 20% withholding for taxes and a 10% early withdrawal penalty when you file your tax return. These fees and penalties can drastically reduce your savings. For these reasons, the cash-out strategy is generally the least favorable option. Tax implications: Heavily taxed and penalized.

So, which solution is best for you? Although individual circumstances differ, the benefits of rolling over a 401(k) to an IRA can often typically outweigh the other options for many people. Here’s why.

Benefits of rolling over your 401(k)

Today, the rollover process has become more streamlined and simplified. While this simplicity is a bonus, there are five distinct advantages to an IRA rollover.

Advantage No. 1: Greater investment choice and account mobility.

Depending on your former employer’s retirement plan, your old 401(k) asset allocation may not have kept up with the times. For example, many old plans had limited investment options. Others may have locked you into so-called low-risk “stable” options as defaults.

Now is your opportunity to hit the reset button and create an investment portfolio that is more in line with your current financial objectives. It’s your chance to customize your own retirement plan. And because your IRA won't be connected to your employer, you may have more flexibility, privacy, and control, so you can change jobs with less worry.

Advantage No. 2: Lower costs.

High fees also weigh down some older plans. Unfortunately, these fees—to invest, withdraw money, take a loan, and for recordkeeping and printed statements—are often passed on to retirement plan participants like you.

Some of these account fees may still exist today. But many have vanished, in part because there's more transparency, and it’s much easier to track charged fees.

Advantage No. 3: Consolidation.

Keeping up-to-date on various isolated accounts is not easy—especially as individuals age and life gets busier and more complex. Consolidating retirement accounts can make tracking assets more convenient. But it's more than that. Bringing together retirement assets in one place also can help you visualize where you are in your retirement plan and how far you need to go. It can paint a more complete investment picture of your total asset allocation, risk exposure, and overall return.

Advantage No. 4: No taxes or penalties with a direct 401(k) rollover.

Participants can move money from one retirement account to another without penalty. This is known as a direct rollover. But don’t make the mistake of having your old company cut a check payable to you. This is considered a distribution and means your 401(k) plan is required to withhold 20% for taxes.

Advantage No. 5: More options for early withdrawals.

Although taxes will be owed, IRAs allow early distributions without penalty for certain expenses, like higher education and first-time home purchases. Conversely, the 10% tax on early withdrawals from a 401(k) is waived in only a few severe circumstances, like total disability or medical bills that exceed 10% of adjusted gross income. But unlike with a 401(k), you can’t borrow against an IRA.

When should retirement assets stay inside an employer plan?

A rollover may not be the right decision for your situation despite the benefits. There are several reasons why keeping assets in a current 401(k) may make more sense.

| Creditor Protection | 401(k)s generally provide better protection against bankruptcy and claims from creditors. | |

| Loans | Loans from IRAs are not allowed, decreasing financial flexibility in times of need. | |

| Working Longer | If you work past age 73, you do not have to take required minimum distributions (RMDs) from your 401(k). But an IRA would still mandate annual distributions. | |

| Early Retirement | Want to retire early and need income? Individuals can start taking qualified distributions from a 401(k) at age 55, slightly earlier than allowed with an IRA. | |

| Company Stock | Does your 401(k) hold company stock? Unfortunately, transferring it to an IRA may not offer the most favorable tax treatment. Instead, you could move the company stock to a taxable brokerage account in a maneuver called Net Unrealized Appreciation. That way, the gains are only subject to capital gains tax, which is usually lower than income tax. (Net Unrealized Appreciation is a limited time opportunity, so consult with a wealth advisor as soon as you separate if you hold employer stock in your plan.) | |

| Roth Strategies | Completing annual "backdoor" Roth conversions may be tax-efficient for you. (More on this strategy in a moment! And, another excellent topic for you to discuss with your qualified tax advisor!) | |

Refine your retirement strategy under one roof

Saving for retirement seems like a simple concept. But managing a retirement strategy is complex.

It's made even more complicated when assets are spread among various accounts managed independently—with differing and sometimes competing objectives or goals that made sense 30 years ago but may no longer seem appropriate near retirement or in an evolved investment environment.

A noncentralized approach can make selecting an appropriate asset allocation and risk level overwhelming, even for the most financially astute.

Case in point: Harry Markowitz, the 1990 Nobel Prize in Economics recipient. Known as the father of Modern Portfolio Theory, Markowitz's research on the efficient trade-off between risk and return underpins most asset allocation models. Still, he famously split his portfolio evenly between stocks and bonds in the 1950s. But Markowitz recognized that what worked in 1952 may not work today, explaining he now divides his money "among asset classes, like efficient portfolios…"

This example illustrates the importance of refining investment strategy and asset allocation. Because what worked in the past may not work now. But it’s hard to know where you stand when retirement assets are all over the place.

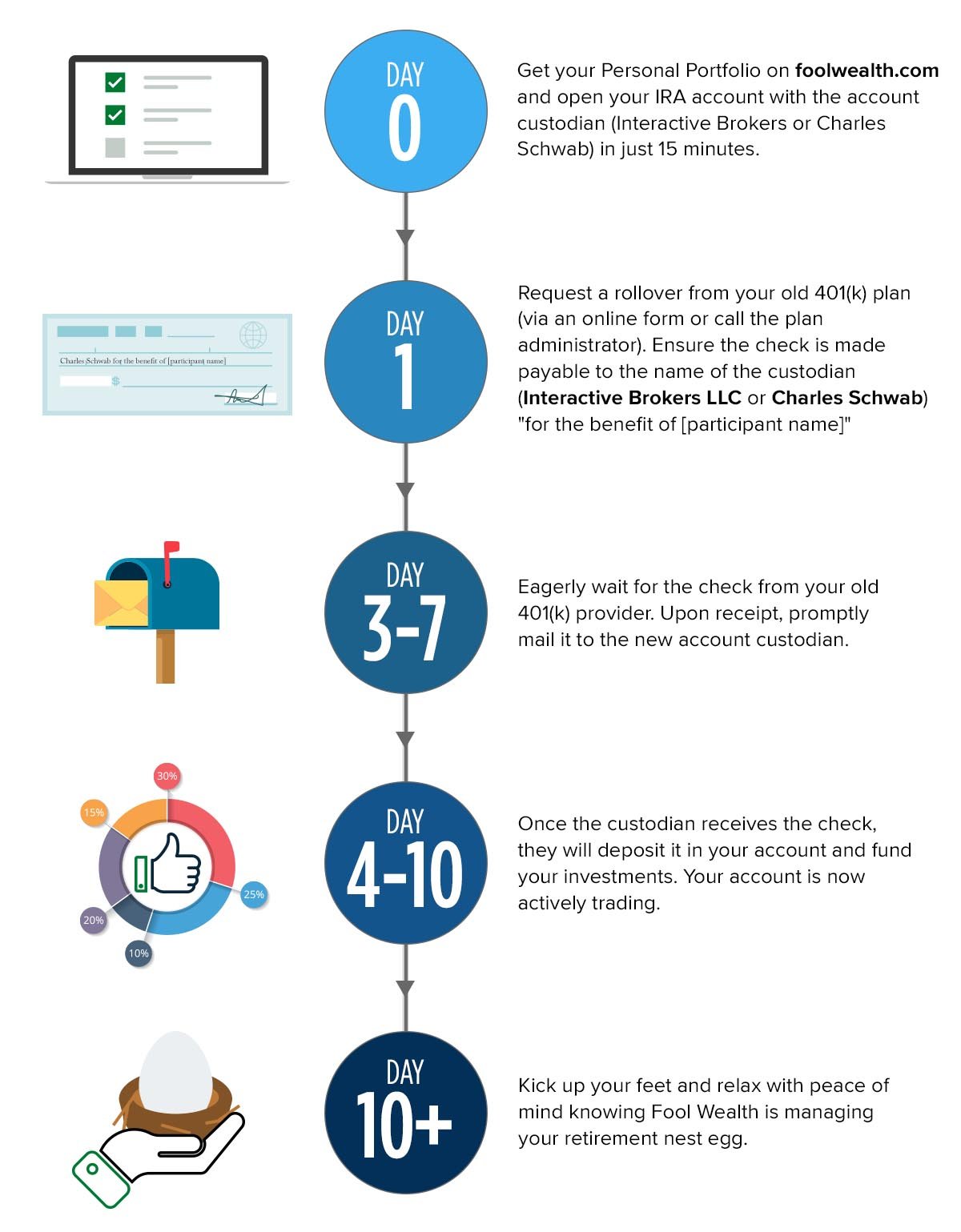

Fortunately, rolling over an old 401(k) can be simple and easy. Here’s how to get started:

Source: Motley Fool Wealth Management

So, “rolling over your 401(k)” is just a fun way of saying that you’re going to move your money from a 401(k) account to a different kind of retirement account, such as an IRA. There are a few of these kinds of money movements you can make among retirement accounts.

Enter the "IRA Conversion"

A Roth IRA conversion is when you take all or part of your existing traditional IRA or 401(k) and move it into a Roth IRA.

As we discussed earlier, there is the distinct advantage of not having to pay taxes on withdrawals from a Roth IRA, and so we often hear something along the lines of, "I want to avoid paying taxes, so I'm going to move all my IRA money into a Roth IRA.”

For some people, this move may make perfect sense. But for others, it may not.

The crux of the issue is tax optimization: Which is better—small tax payments over time (via traditional periodic distributions) or one large tax payment immediately (Roth conversion)?

What’s the breakeven?

Taxpayers can convert a traditional IRA into a Roth, even if they’ve started taking their required minimum distributions. However, a taxpayer cannot change over just the annual RMD into a Roth.

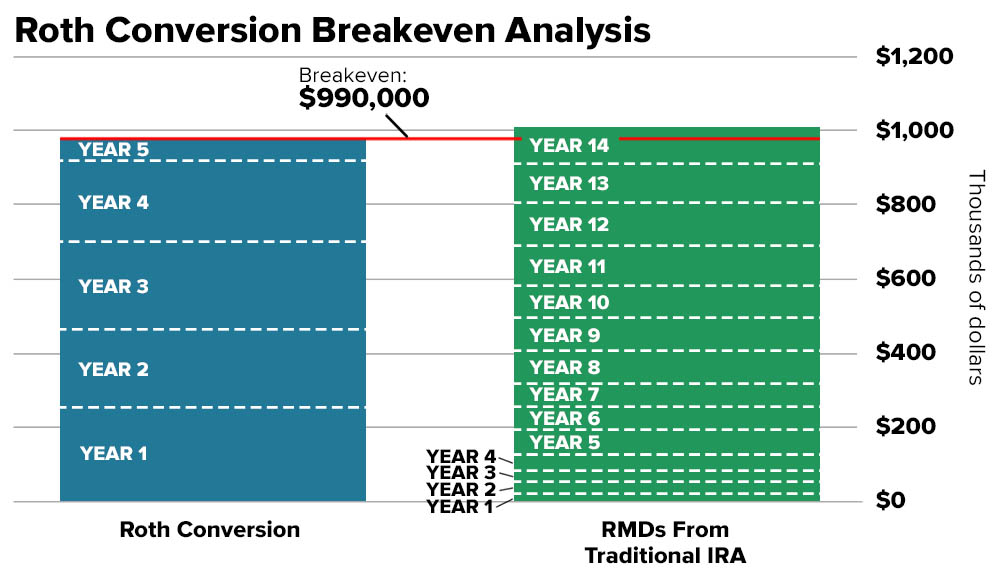

One way to assess whether a Roth or traditional IRA could be best suited for your situation is to look at a breakeven analysis, which examines the point at which profit and loss are equal.

Consider the following hypothetical example:

David and Janice, both in their mid-70s, were contemplating moving $2 million from their traditional IRA assets into a Roth. The reason was simple: Their RMDs from a traditional IRA exceed their living expenses. In addition, by having a higher income, they may be subjected to increased Medicare premiums or a higher hurdle for deducting medical expenses on their tax returns.

But by moving their assets to a Roth, they would not be required to take—or pay taxes on—distributions they did not need.

Their Fool Wealth planner performed a breakeven analysis based on a five-year conversion plan. Notably, leaving a legacy was not a priority for them. The results were as follows:

What does this chart tell us? First recall that the money David and Janice put in their traditional IRA was not taxed.

So when they convert funds from their traditional IRA to a Roth IRA, they will have to pay taxes immediately on the amount shifted into a Roth.

That is what the blue bars show. So in Year 1, they would pay taxes of $246,481 based on a 35% tax rate.

Now, compare that to the tax bill on their RMDs if they keep the money in their traditional IRA (green bars).

Because their annual RMD is lower than the amount converted into a Roth, and their tax rate is based on their applicable marginal rate, the tax bill each year is lower than the Roth conversion. For example, in Year 1, they would pay $19,881 in taxes.

So should they convert to a Roth? The analysis shows that David and Janice's breakeven for a Roth conversion would be 14 years.

Said a different way, it would take them 14 years for the amount paid in taxes on their annual RMDs to equal the amount paid in the Roth conversion.

So each would be well into their 80s before the switch made tax sense. And because they were not interested in leaving money to heirs, a Roth conversion did not make sense for them.

Converting via the "Backdoor"

"Backdoor" Roth conversions have been widely touted as a "rich person's Roth." That's because if your income exceeds the maximum limit to contribute to a Roth directly, you can take the indirect route of adding the annual maximum amount to a traditional IRA and then immediately transferring that contribution to a Roth account. Many wealthy Americans have reportedly socked away a pretty penny this way.

Is this a scheme to dodge taxes?

Yes and no. Yes, a backdoor Roth strategy will decrease the taxes you pay over your lifetime, but it is also perfectly legal. Investors have to pay a tax on all non-taxable money that moves from a traditional to a Roth in the transition year.

While this strategy is legitimate, it has nonetheless drawn lawmakers' focus. However, at this point, the backdoor Roth still lives on.

What are the advantages of building your Roth IRA?

The benefits of this financial maneuver to increase your Roth assets can be numerous. For instance, as we mentioned earlier, all earnings in a Roth IRA grow and are withdrawn tax-free.

In addition, Roths do not require RMDs. This means assets can continue to compound tax-free for the rest of your life and beyond. That's why many may view this type of account as an excellent way to transfer funds to heirs.

As with everything related to estate planning, leaving your Roth IRA to heirs has its own set of rules. The basic gist is:

- Spouses who inherit a Roth IRA can treat it as their account and are not required to draw down the account during their lifetime.

- Particular specially classified beneficiaries who inherit a Roth IRA maintain the "stretch" distribution schedule throughout their lives.

- Other non-spouse beneficiaries—such as children, grandchildren, other family members, and friends—must take distributions of all the assets in the account within 10 years of the original owner's death.

There are other rules, so consult a tax professional for all tax advice.

But not everyone is a good candidate for a backdoor Roth...

For example, if you already have before-tax contributions held in a traditional IRA, converting to a Roth may not be tax-efficient.

The reason is complicated, but if your IRA consists mainly of pre-tax contributions and you have significant accumulated earnings, most of the funds you convert to a Roth IRA will likely count as taxable income at the time of the conversion.

You aren't allowed to "cherry-pick" and only transfer the after-tax balance, which could kick you into a higher tax bracket in that year. If that's the case, it may make sense to wait until retirement, when you'll likely be in a lower tax bracket.

But start with a fresh slate. Even though your contributions will be taxed immediately, you won't have to pay taxes on earnings—which is one of the advantages of backdooring into a Roth.

Contrast that with socking away the same amount in a taxable investment portfolio. Similarly, your investment dollars will be taxed immediately. But they're also taxed when you sell appreciated positions.

Let’s walk through an example

Larry recently graduated college and is saving $6,000 a year over and above his employer's 401(k) contributions.

However, Larry's income is over the limit for contributing directly to a Roth IRA, so he thought the Roth just wasn't in the cards. That is until his colleague mentioned that he might be better off doing a backdoor Roth instead.

So he decided to speak with a financial advisor to understand his options. Here's the analysis the advisor reviewed with Larry.

Larry’s advisor assumed he would make an annual contribution of $6,000 for the next 30 years. In addition, the advisor based the growth of the investments on the long-term average return of 8.29% of a 50% stock/50% bond portfolio5.

| If in a taxable brokerage account | |

|---|---|

| Accumulated Balance: | $499,699 |

| Taxable Account Tax Rate:Assuming 15% Federal + 5% State | 20% |

| After-Tax Value: | $579,759 |

| If in a Roth | |

|---|---|

| Accumulated Balance: | $499,699 |

| Roth Account Tax Rate: | 0% |

| After-Tax Value: | $679,759 |

| Tax benefit of a Roth over a taxable account | $100,000 |

|---|

This example shows the potential tax advantage—$100,000 in this example—of the backdoor Roth over a taxable investment account. And while Larry was embarking on his career, those well into their careers may also see substantial benefits.

What's your "why" for doing a backdoor Roth?

While converting to a Roth appears to be the financial move du jour, the decision should be highly individualized. Larry's decision should weigh other factors—such as his wealth goals—and the after-tax value.

For example, does he want to spend his contributions before 59½ years old? If so, then a Roth could make sense. But if he needs to dip into the earnings, he may get penalized and taxed.

Something else to mull over? Managing your future tax bracket.

The backdoor Roth is an effective technique for controlling future overall tax rates. In other words, by drawing spending needs from this tax-free bucket in retirement, your taxable annual income will not increase.

Thus, your tax bracket should be unaffected. In contrast, spending from a taxable investment account or a traditional IRA could raise your tax bracket.

But as with everything, there are other pros and cons. That's why it's essential to look at it from all angles. Again, a financial planner and tax professional can help guide your decision.

Choosing a Retirement Account is Not Necessarily Mutually Exclusive

Choosing a Retirement Account is Not Necessarily Mutually Exclusive

We just spent a lot of time explaining the similarities and differences among the various retirement savings accounts. But in practice, they're not mutually exclusive. You can potentially invest in all three at the same time.

But if you do, the available tax benefit may be lower or unavailable in the year you make the contribution. And whether you have just one or multiple IRAs, your total annual contribution is still capped at $6,500 ($7,500 over age 50). There are other rules, so consult with a tax professional to understand the impact on your situation.

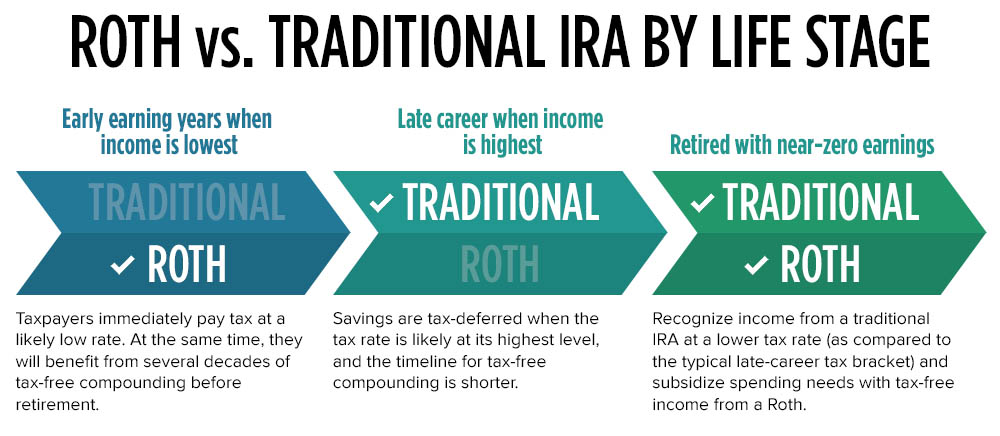

In general, we believe you should start with a 401(k) if one is available to you. And if you are able, max out your contributions and take advantage of any company match program. Then consider an IRA.

Not sure which makes sense for you? This chart may help.

But consider this: the optimal solution may be a mix of both.

That way, individuals could take deductions at the highest tax bracket while working and recognize income in the lowest tax bracket in retirement. This tax-arbitrage strategy is lost if 100% of assets are in only one approach.

Source: Motley Fool Wealth Management

You've Saved. Now It's Time to Withdraw

You've Saved. Now It's Time to Withdraw

Taking money from your retirement accounts requires mental reprogramming on the tax front. You've been trained to avoid taxes. But in retirement, you have to switch gears to managing taxes.

Rather than mitigating taxes at the top marginal rates as you did while working, you are building your tax situation from the ground up in retirement, starting at a 0% bracket and working up the ladder.

The flexibility you have depends on the amount of money you need to maintain your lifestyle and where it falls within the tax bracket thresholds. The lower your income need, the more flexibility you have.

Summarizing your retirement account options

This table compares 401(k)s, traditional IRAs, and Roth IRAs to help make your choice a little easier.

| 401(k) | Traditional IRA | Roth IRA | |

|---|---|---|---|

| Administered by | Third-party administrator chosen by the employer | Individual | Individual* |

| Contribution Frequency | Deducted from payroll and benefits from dollar-cost averaging | At least annually before tax-filing day for prior tax year | At least annually before tax-filing day for prior tax year |

| Money Contributed | Before tax | After tax but eligible for a tax deduction | After tax |

| What is it taxed? | At withdrawal | At withdrawal | Potentially never. Grows tax-free |

| Annual contribution limits before age 50 (after age 50) | $22.5K ($30K) | $6.5K ($7.5K) | $6.5K ($7.5K) |

| Maximum income limit | None+ | No limit, but the ability to take a tax deduction varies depending on filing status (married vs. single) and if you or your spouse has a retirement account at work# | $228,000 (married) $153,000 (single) |

| Penalty for withdrawal before age 59½ | 10% | 10% | No penalty on contributions. 10% on earnings only unless meet the 5-year rule |

| Penalty exceptions | If the participant has a total and permanent disability; for unreimbursed medical expenses, depending on the amount relative to your adjusted gross income. | If the owner has a total and permanent disability; for qualified first-time homebuyers up to $10K; for health insurance premiums paid while unemployed; for unreimbursed medical expenses, depending on the amount relative to your adjusted gross income. | If the owner has a total and permanent disability;for qualified first-time homebuyers up to $10K; for health insurance premiums paid while unemployed; for unreimbursed medical expenses, depending on the amount relative to your adjusted gross income. |

| Investment options | Often limited | Unlimited | Unlimited |

| Required minimum distributions? | Yes, starting at age 73 | Yes, starting at age 73 | No |

| Most advantageous | When offered by a current employer, especially when a company match is available | When income is high and you expect taxes to be lower in the future | When income is below the limit and taxes are lower today than in the future |

All data is relevant for the 2023 tax year.

*Some employers may administer a Roth IRA.

#Consult a tax professional to discuss your individual situation.

+High-income earners may not be able to max out their contributions. This is due to an ERISA regulation that requires testing to ensure that the plan isn't considered too "top-heavy."

The Greatest Gift You Can Give Yourself (And Your Family!)

The Greatest Gift You Can Give Yourself (And Your Family!)

We think the most crucial takeaway from this discussion is one simple word: Save. And start early.

Sure, later in your career, you will likely make more money, but you also will have more expenses. If you make delaying saving “okay,” you may never get around to saving seriously for retirement.

And the longer you wait, the less time there is for compound growth to multiply your contributions. So, your retirement account at retirement will be composed mainly of your contributions rather than the growth your contributions could generate.

This loss of compounding is often irreplaceable. So give yourself the gift of time and let the market potentially work for you!

Because history has shown that investments can appreciate over the long haul, despite inevitable market downturns.

Case in point: The S&P 500® Index has generated an average annualized return of 10% from 1926 through 2022.7

Many people are curious about the spending and saving habits of the wealthy. Well, in terms of saving for retirement, an IRA is the most commonly used account by affluent Americans.

Another tenet well-to-do individuals understand? The earlier you start, the more compounding can potentially grow your money.

So no matter your age or how much you can squirrel away each month, the greatest advice is to save, save, save!

Join our email list for updates

Stay in touch by signing up for our weekly newsletter. You’ll be the first to hear the latest updates about Fool Wealth’s transition to Apollon, plus fresh insights on investing and financial planning.